Steep Increase in Household Loans Sparks Debates on Debt Explosion in Korea

Household Loan Surge in Korea

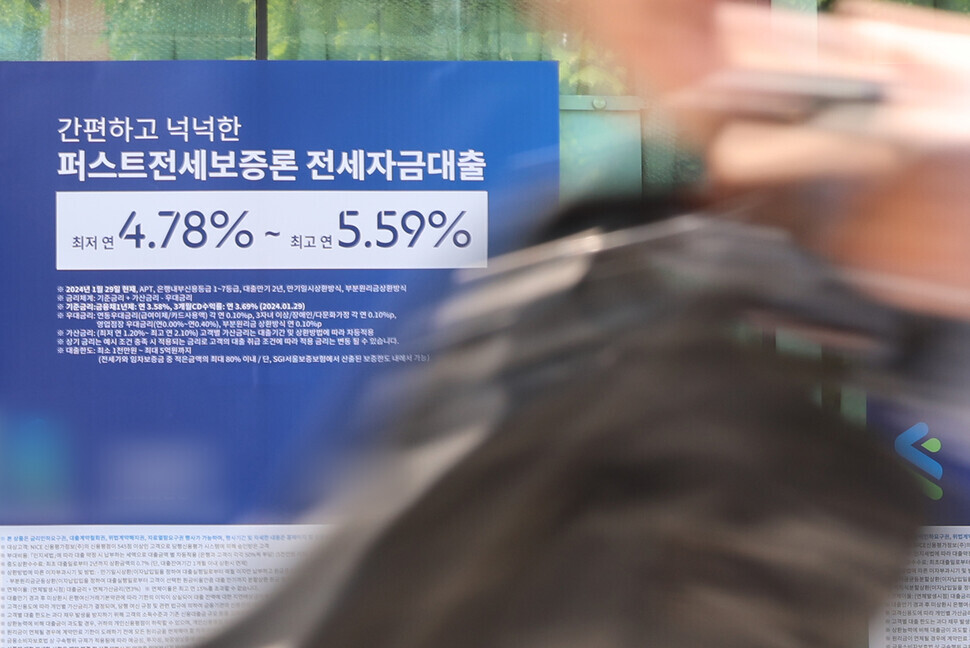

The sudden rise in household loans in Korea has alarmed financial experts, with concerns about a looming debt crisis.

Implications for Financial Stability

This surge, equivalent to 40% of the June increase, has raised questions about the sustainability of current debt levels.

- The significant increase in borrowing within a short timeframe has put pressure on the country's financial stability.

- Experts are closely monitoring the situation to assess the potential risks to the economy.

With households accumulating more debt rapidly, the focus is on understanding the possible consequences and formulating strategies to mitigate any negative impacts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.