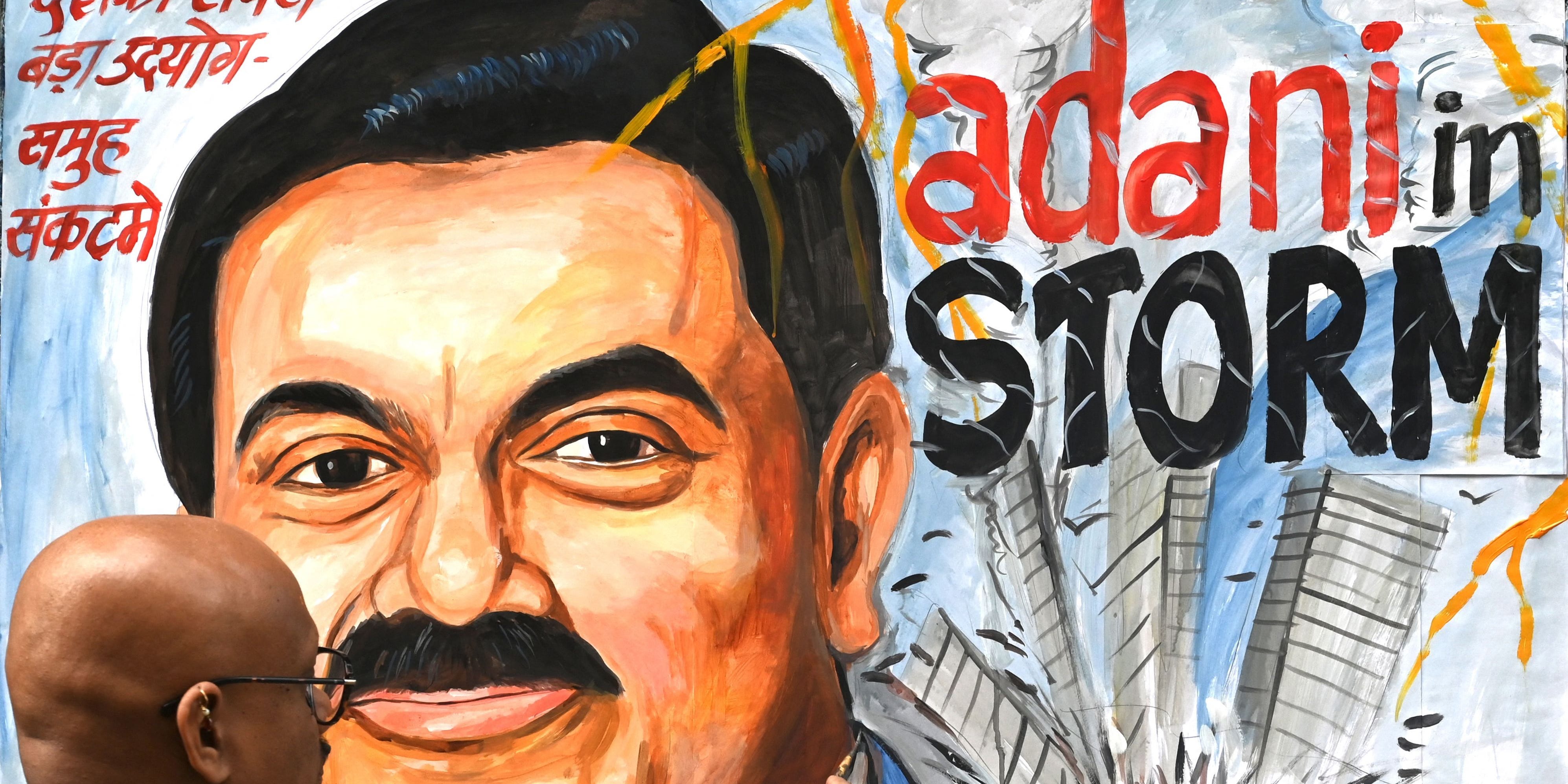

Examining the Effects of Hindenburg Research's Short-Seller Report on Adani Group's Market Value

Saturday, 6 July 2024, 09:22

Key Highlights:

The recent short-seller report by Hindenburg Research on the Adani Group has raised questions about the impact on market value.

Important Points:

- Hindenburg Research report wiped out $150B from the Adani Group's valuation.

- The actual profit made by Hindenburg was only $4M, highlighting the significant effect of negative reports.

This incident underscores the influence that such reports can have on market perceptions and valuations, emphasizing the importance of thorough analysis and due diligence for investors.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.