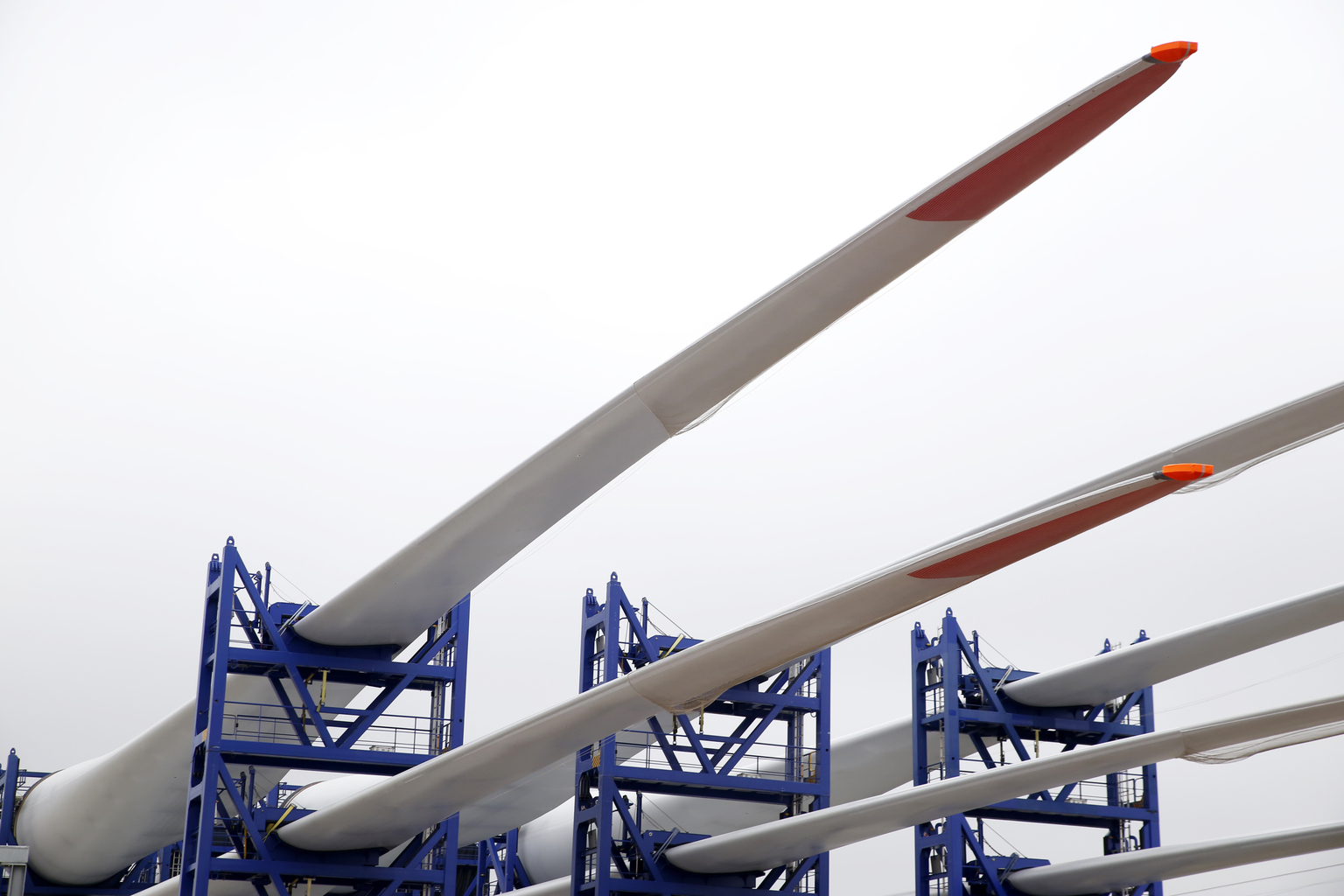

Analyzing TPI Composites' Cash Flow and Historical Performance

Sunday, 30 June 2024, 04:07

Overview

The post offers an in-depth analysis of TPI Composites' financial situation, focusing on cash flows and past performance. It assesses key metrics and trends to provide a comprehensive view of the company's status.

Key Points

Cash Flows: Weak

- Operating cash flow shows instability.

- Investing cash flow indicates capital expenditure.

- Financing cash flow points to debt or equity transactions.

Historical Performance: Inconsistent

- Revenue growth has been volatile.

- Profit margin trend is uncertain.

Conclusion: The analysis suggests caution in considering an investment in TPIC stock due to the company's financial challenges.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.