Underperformance of Shenzhen-traded Companies Raises Delisting Alarm

Delisting Risks for Chinese Companies in Shenzhen

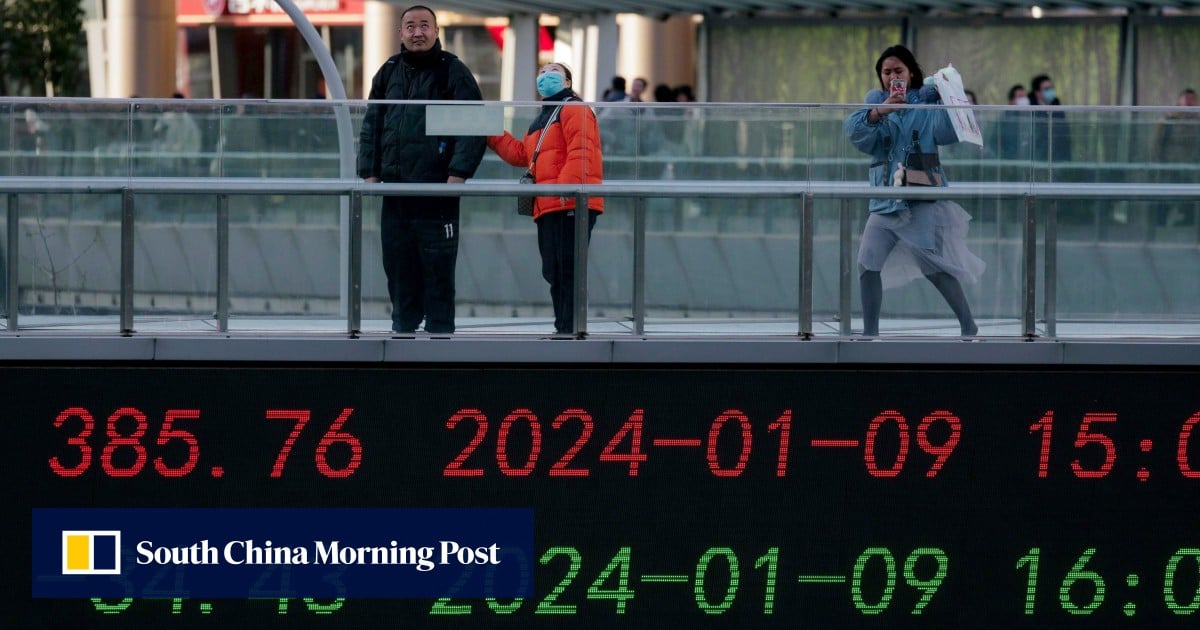

Chinese businesses in Shenzhen are facing challenges as they trail behind Shanghai-listed companies this year. This disparity emphasizes the concerns surrounding the potential delisting of small-cap entities.

Investor Preference for Industry Leaders

Investors are showing a preference for larger industry leaders, a trend that has implications for market dynamics and investment strategies.

Market Dynamics in a Challenging Environment

The underperformance of small-cap firms in Shenzhen reflects the broader challenges in the macroeconomic landscape, prompting a reassessment of risk exposure and strategic positioning.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.