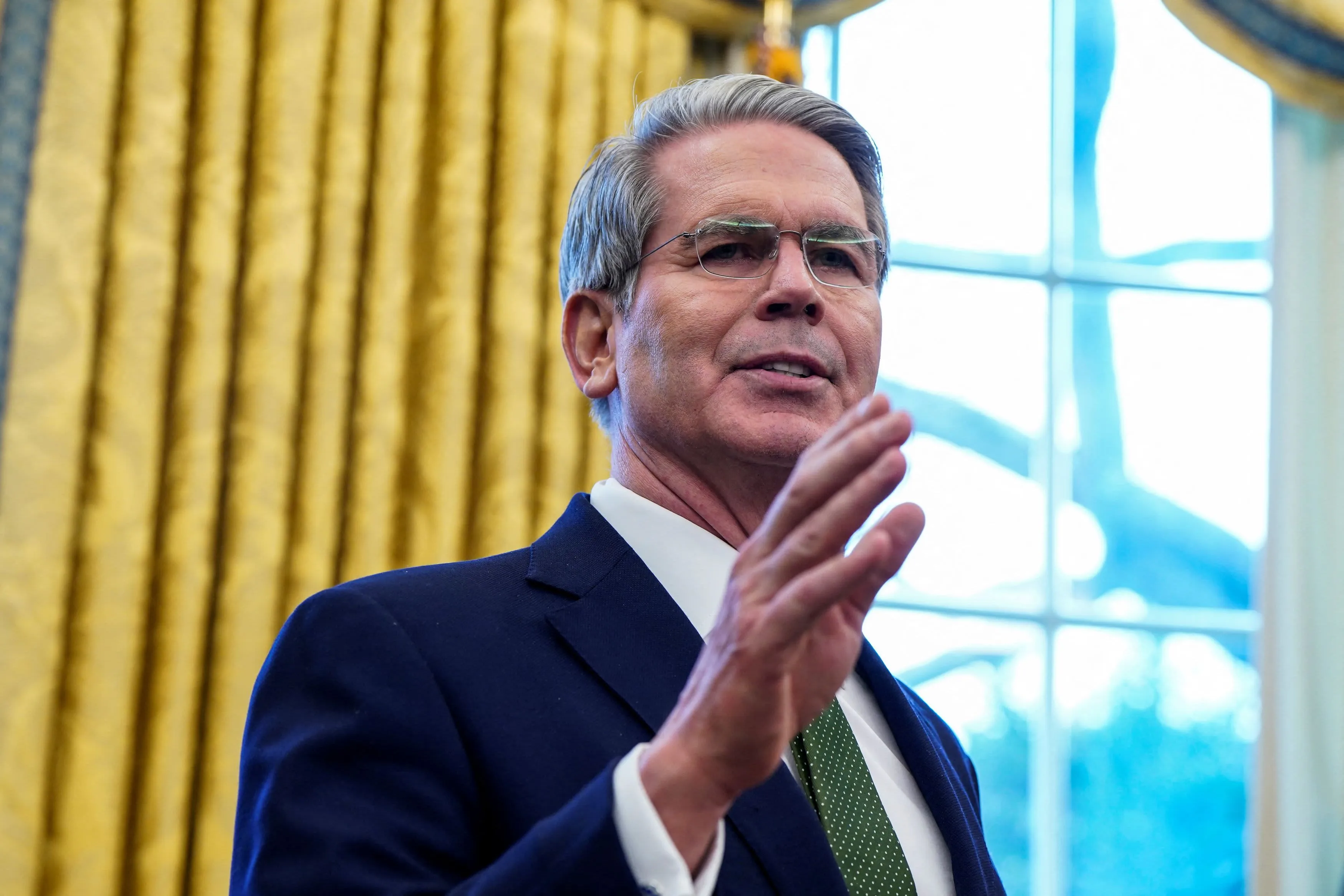

U.S. Department of the Treasury: Secretary of the Treasury's Insights on 10-Year Treasury Yield and Interest Rates

Strategic Focus of the U.S. Department of the Treasury

The U.S. Department of the Treasury's current focus highlights the 10-year Treasury yield as a key indicator of economic health. The Secretary of the Treasury, emphasizing the importance of fiscal policy, seeks to keep rates low without pressing the Federal Reserve Bank for immediate cuts. This strategy reflects a careful alignment with politics and markets.

Impact on the Economy

As the administration intensifies focus on maintaining favorable conditions in business news, attention to the yield serves as a critical measure of investor sentiment. Policymakers evaluate bonds and their influence on broader economic stability.

- Continuous Monitoring of Treasury yields is essential for market participants.

- Strategic fiscal measures can affect business spending decisions.

- Stakeholder engagement with the Federal Reserve Bank enhances policy effectiveness.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.