Effective Strategies to Mitigate the Impact of Inflation on Insurance Expenses

Wednesday, 12 June 2024, 13:10

Tips to Lower Insurance Costs:

- Understanding the Impact of Inflation on Insurance Rates

- Implementing Cost-Saving Measures in Policy Selection

- Jo Ling Kent Advice on Negotiating Better Premiums

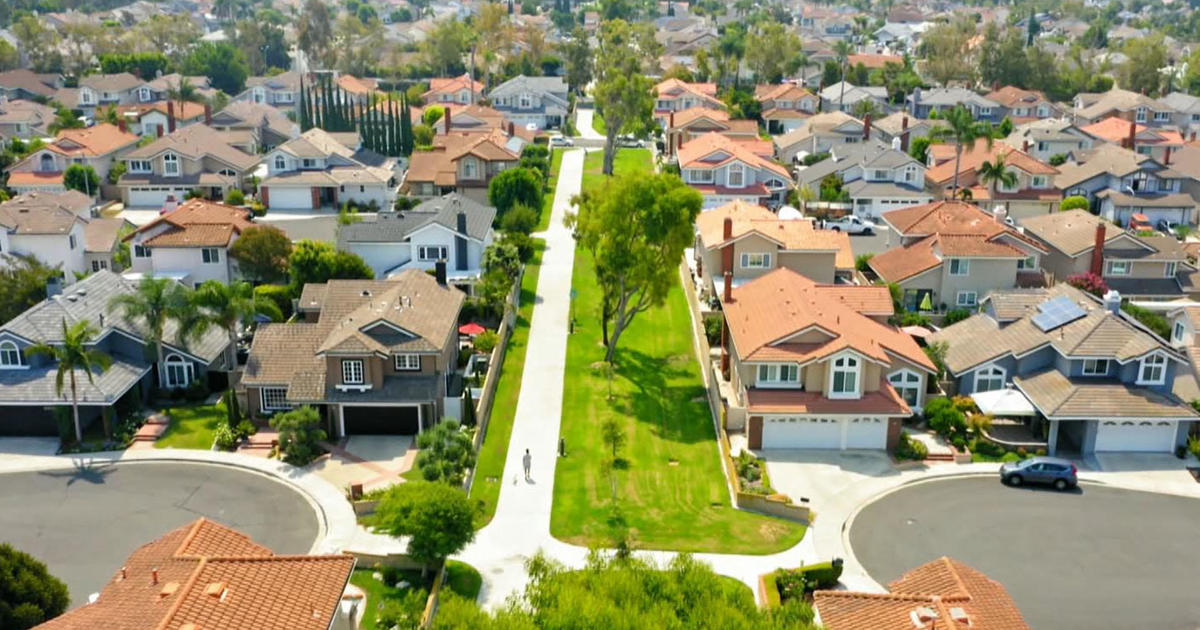

Inflation continues to drive up insurance costs across various sectors, with homeowners experiencing an 11% increase in rates in 2023. To address this financial challenge, individuals must proactively seek ways to reduce their insurance expenses, ensuring financial stability amidst inflationary pressures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.