Exploring Investment Strategy with Berkshire Hathaway: The Dividend Discussion

Understanding Berkshire Hathaway's Unique Investment Strategy

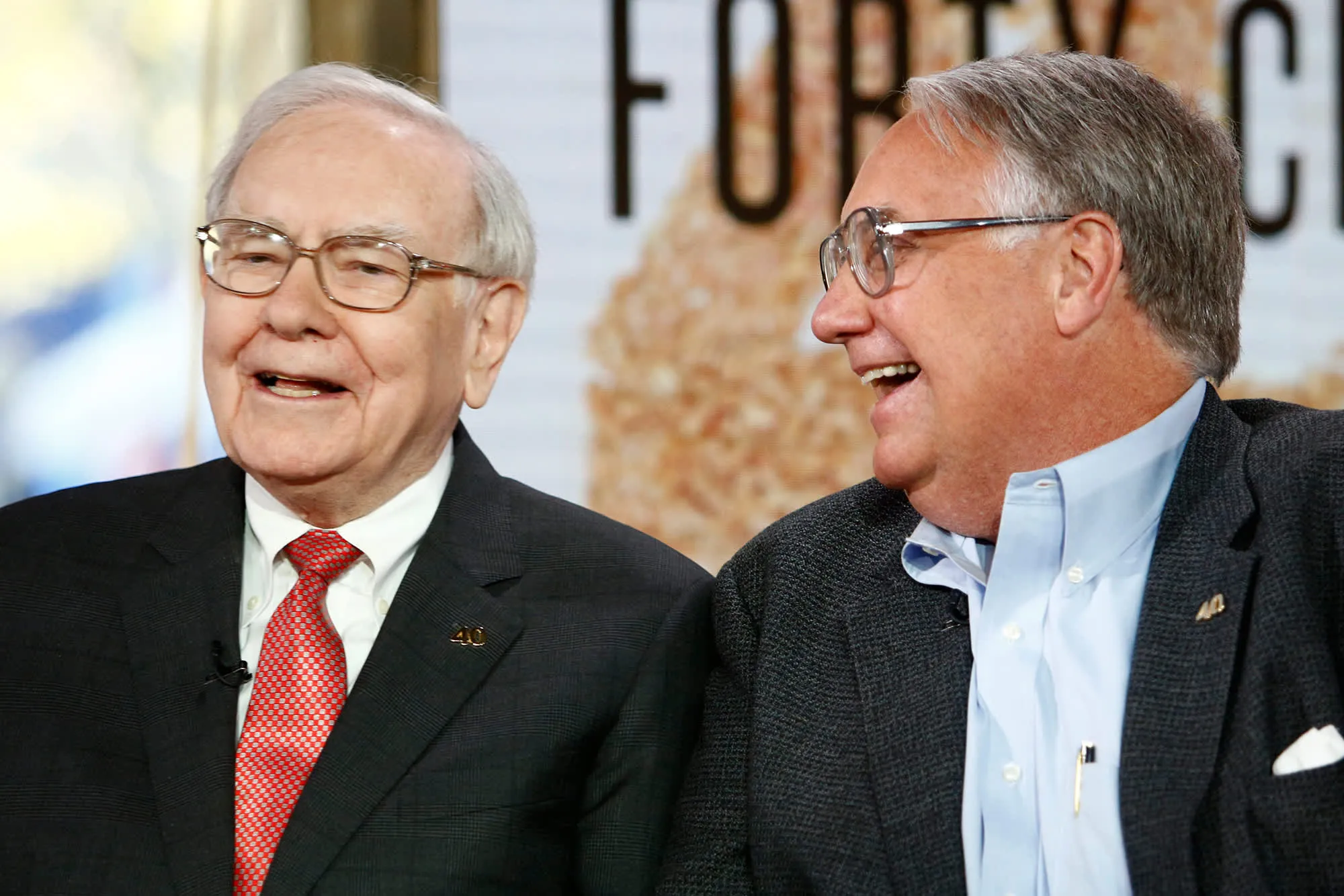

Berkshire Hathaway, under the leadership of Warren Buffett, has not paid a dividend in nearly 60 years. The company’s investment strategy has focused on reinvesting profits to fuel growth rather than returning capital to shareholders through dividends. This approach has provoked discussions around the future of dividends as Howard Buffett steps into a leadership role.

The Role of Dividends in Stock Markets

- Importance of dividends in providing steady income to investors

- Impact of a company’s dividend policy on its stock market performance

- Warren Buffett's philosophy on reinvestment versus dividends

Future Outlook for Berkshire Hathaway’s Dividend Policy

Howard Buffett’s cautious response on dividends signals potential changes in investment strategy. As Berkshire Hathaway continues to navigate market dynamics, the question remains: could dividends make a return, or will the tradition of reinvestment persist?

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.