Biden Administration Caps Overdraft Fees at $5 — Significant Savings for Consumers

New Overdraft Fee Regulations Under Biden Administration

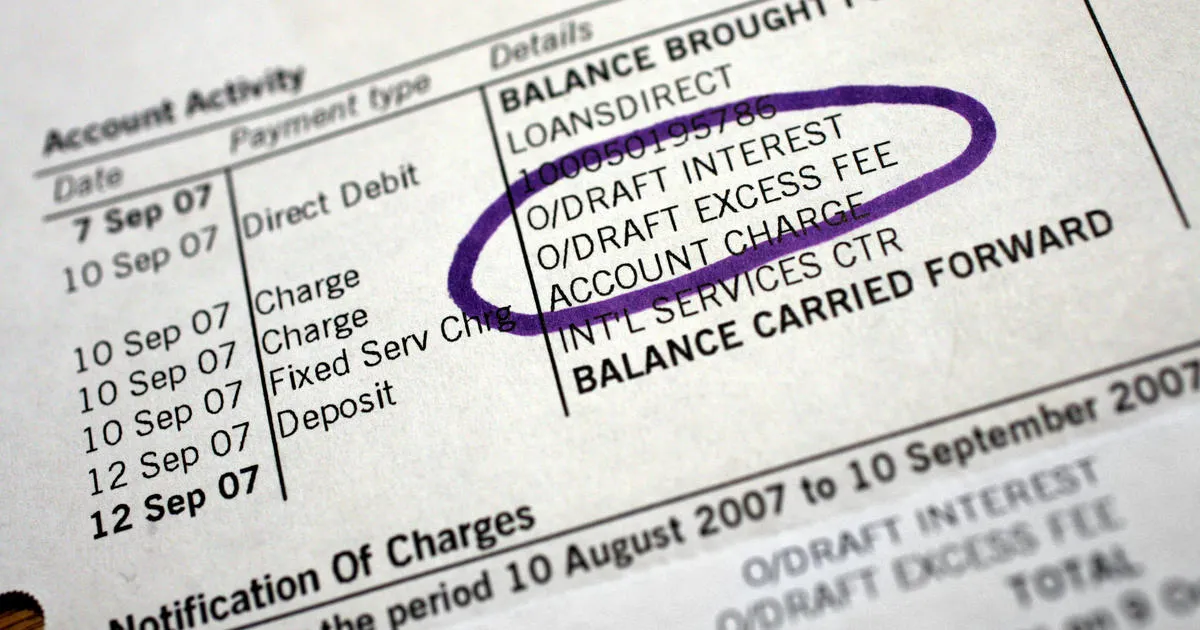

In a groundbreaking move, the Biden administration has put forth a cap on overdraft fees, limiting them to a maximum of $5. This change, spearheaded by the Consumer Financial Protection Bureau (CFPB), is expected to bring about considerable financial relief for consumers across the nation.

Impact on Financial Institutions

The new rule applies to banks and credit unions with assets exceeding $10 billion. These institutions are now required to choose from three options regarding overdraft fees:

- Charge a flat overdraft fee of $5

- Implement a fee that accurately reflects their costs or losses

- Continue charging fees of any amount, provided they disclose the terms and comply with lending laws

Prior to this regulation, banks were allowed to set their overdraft fees at will, averaging around $35 per occurrence, according to the CFPB.

Anticipated Consumer Savings

This regulation is projected to save consumers a whopping $5 billion annually in overdraft fees, translating to approximately $225 per household that incurs such charges. The CFPB is optimistic that these changes will foster better financial practices among consumers.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.