Auto Loans At Record Highs: Understanding the Surge in Delinquencies

Auto Affordability: A Growing Concern

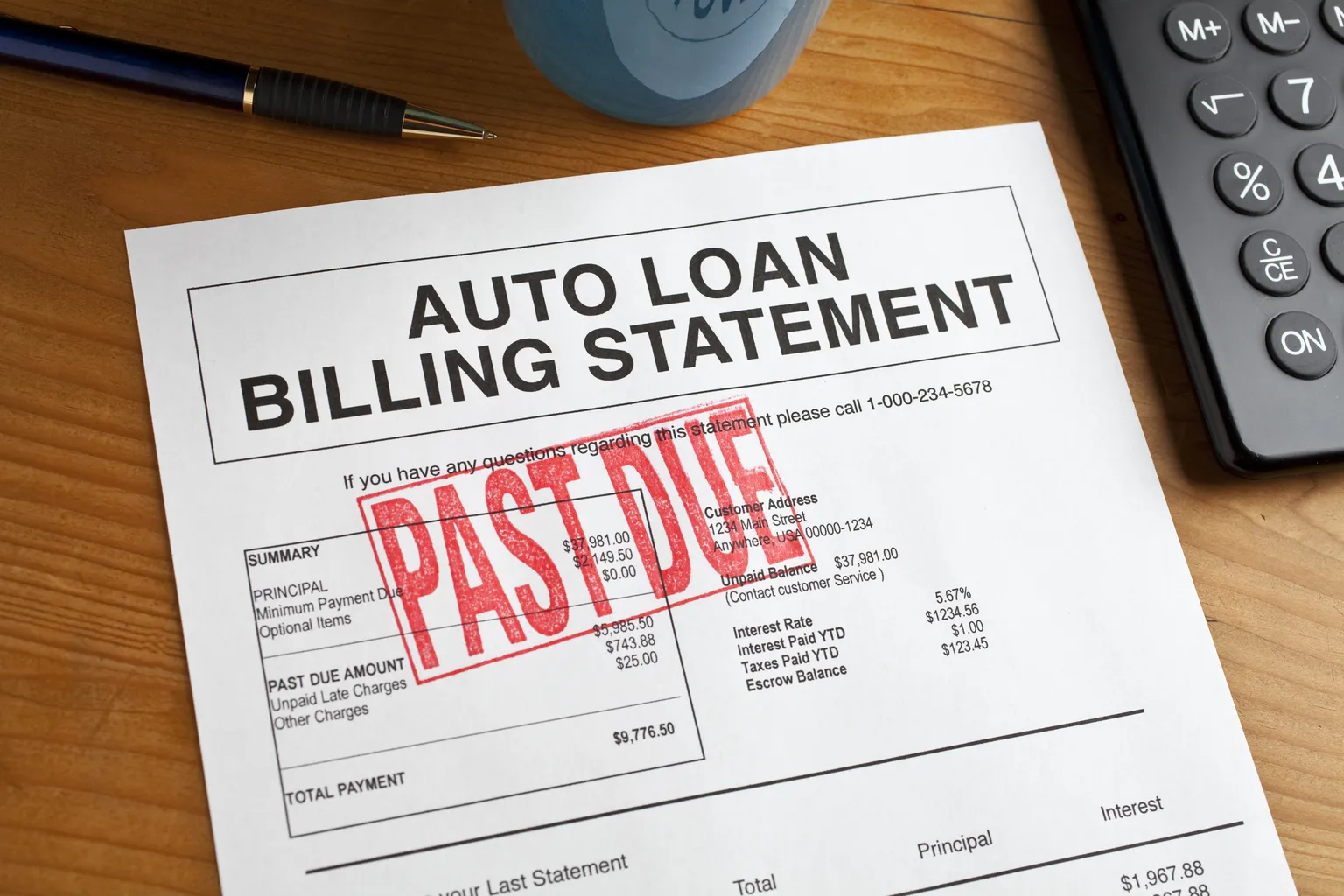

As auto loans reach record levels, rising interest rates and soaring car prices are straining consumer finances. The immediate impacts are evident, with delinquency rates climbing sharply, raising alarm bells across financial sectors.

Driving Factors Behind Rising Delinquencies

- Increased car prices—affordability is becoming a significant challenge.

- Higher interest rates create additional debt burdens for consumers.

- The compounded effect is leading to a spike in loan delinquencies.

Market Implications

These developments could have widespread effects on the financial markets and overall economic outlook. Investors should monitor these trends closely, as they signal potential risks in the market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.