Moody's Ratings Influence the Upcoming HK$20 Billion Retail Infrastructure Bond in Hong Kong

Bond Details and Implications

The Hong Kong government is set to raise HK$20 billion (US$2.7 billion) with its new retail infrastructure bond issuance, letting citizens engage in the city's growth. The three-year bonds will offer half-yearly interest linked to the consumer price index, with a guaranteed minimum return of 3.5 percent.

Financial Secretary's Insight

Financial Secretary Paul Chan Mo-po emphasized the bond's role in providing a safe and reliable investment option while fostering financial inclusiveness.

- Subscription period: November 26 to December 6

- Potential size increase to HK$25 billion

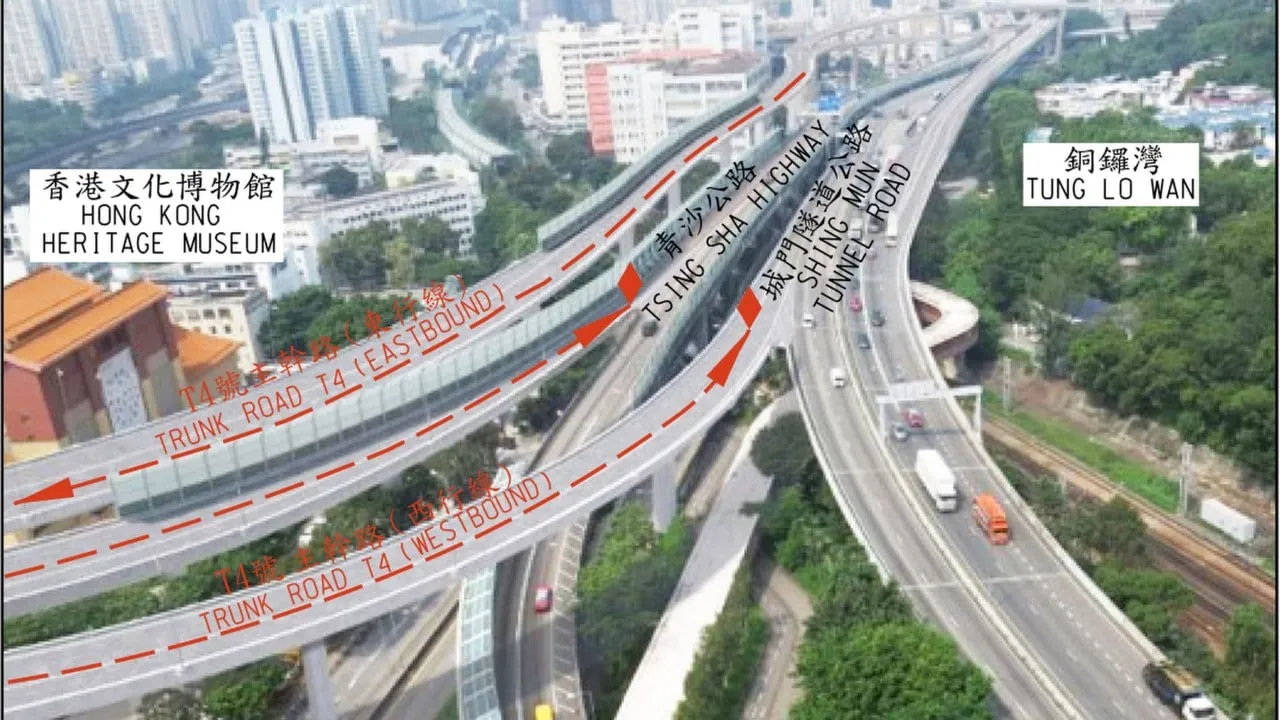

- Proceeds earmarked for critical infrastructure projects

Market Reactions

Analysts like Arnold Chow of BOCHK highlight the bond's attraction despite a lower guaranteed rate compared to previous offerings. Rated Aa3 by Moody's, this bond is appealing to low-risk investors, as noted by Wong Tsz-cheuk from HSBC.

Global Bonds and Economic Relations

In a related development, China's finance ministry also issued US$2 billion of senior bonds, marking a significant milestone in China-Middle East financial relationships.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.