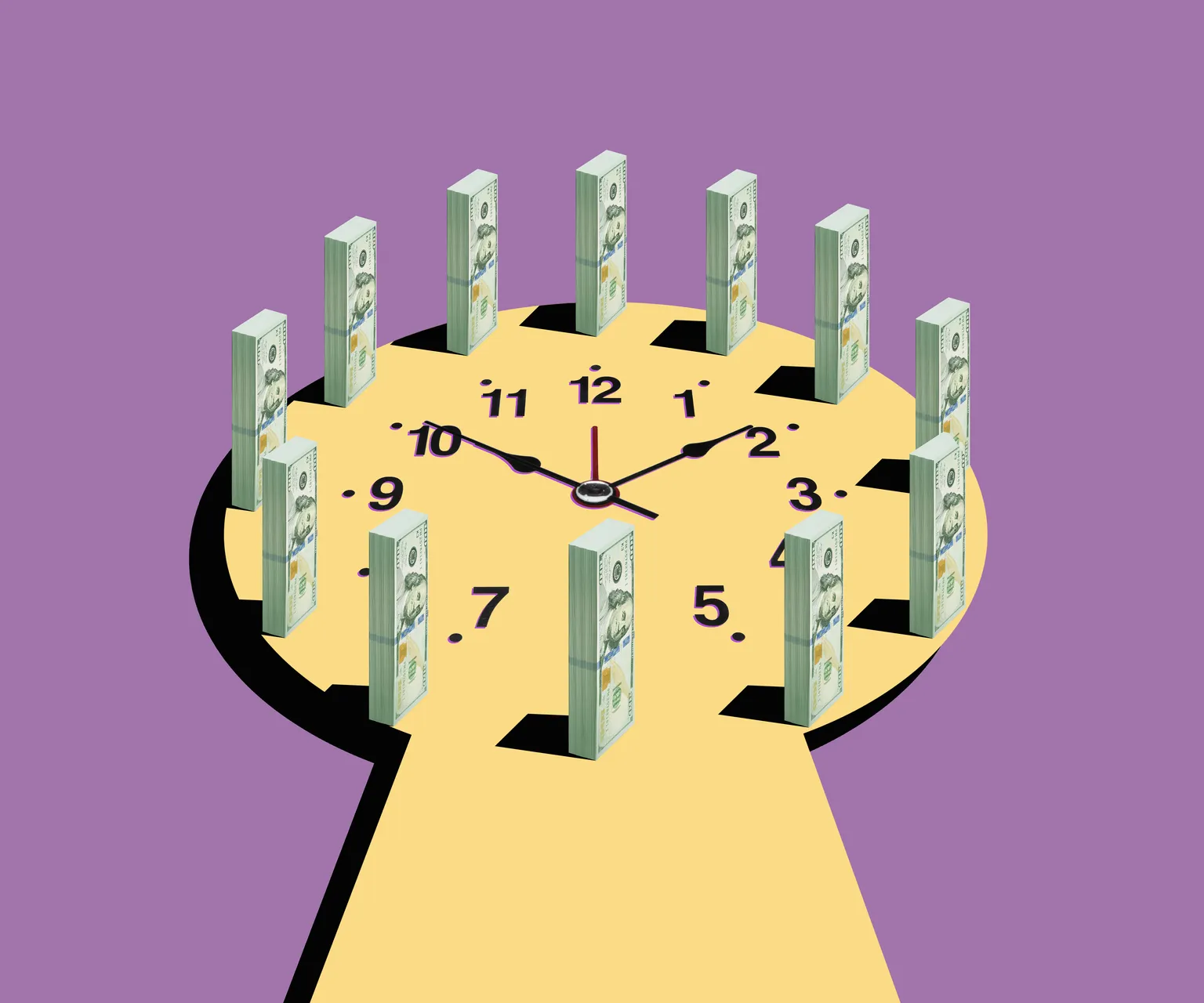

Exploring Why Not All Dividend ETFs Are Created Equal in Dividend Growth Investing

Defining Dividend ETFs

Dividend ETFs represent a collection of stocks that provide regular dividend payments. However, it is essential to remember that not all dividend ETFs offer the same quality of dividend growth. Factors such as expense ratios, yield, and portfolio composition can greatly influence their performance.

Key Factors to Consider

- Expense Ratios: ETFs with lower expenses tend to perform better in the long term.

- Yield: A high yield may seem attractive, but it’s essential to consider sustainability.

- Portfolio Composition: Diverse holdings versus concentrated ones can impact growth rates.

Conclusion: Investment Implications

Investors must be vigilant in their evaluations. As the market evolves, selecting the right dividend ETF can significantly impact long-term wealth accumulation. Engaging with these dynamics equips investors with a solid framework for navigating the evolving landscape of dividend growth investing.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.