Breaking News: Markets Await Fed's Direction on Interest Rates

Breaking News: Economy Shows Strength

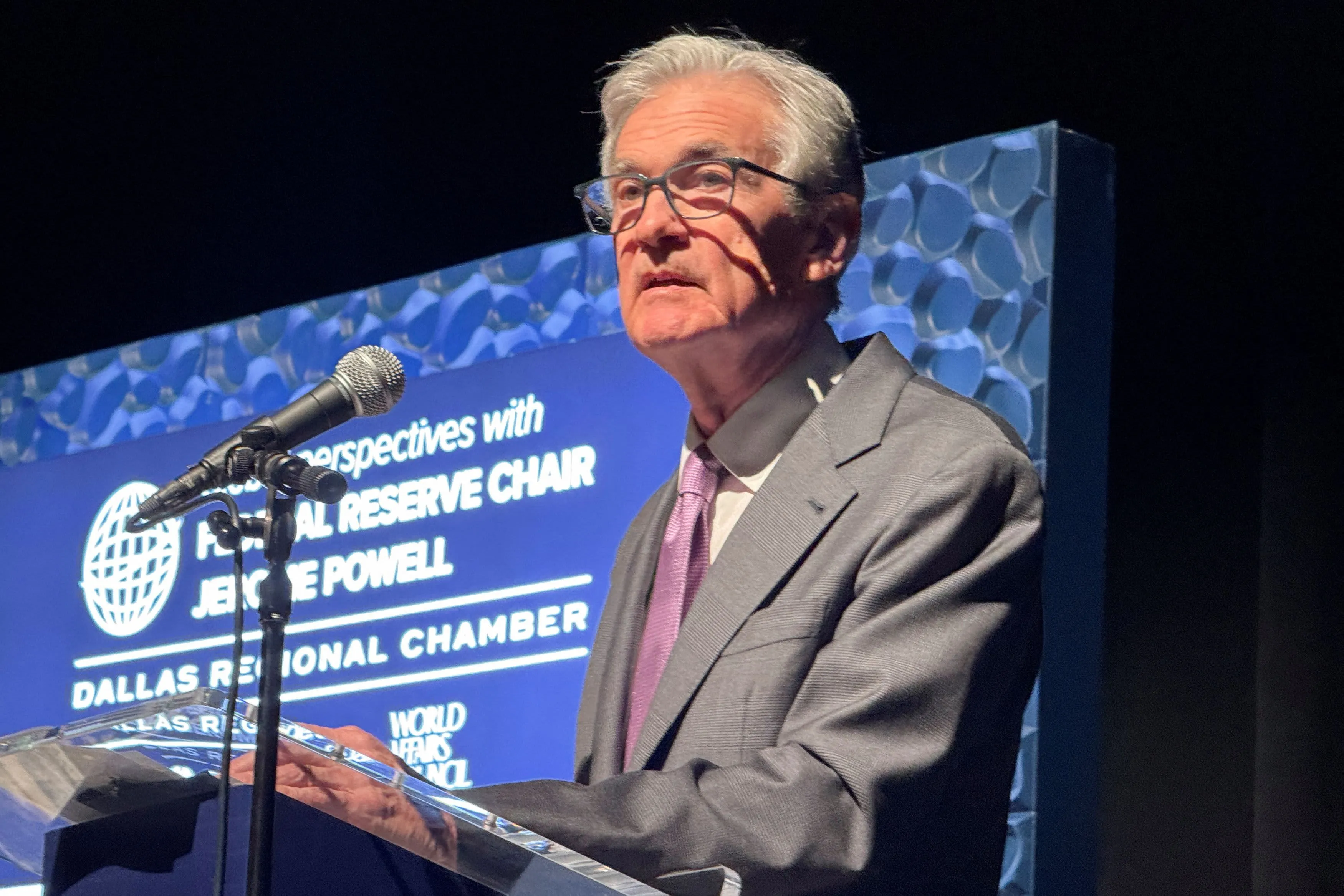

Jerome Powell, Chairman of the Federal Reserve, recently stated that the economic strength we are witnessing allows the Fed to proceed with caution regarding interest rates. In his remarks, Powell emphasized that the current market conditions do not necessitate an immediate reaction, indicating a stabilizing view on inflation and prices.

Key Points from Powell's Remarks

- The economy is exhibiting resilience.

- No hurry to adjust interest rates.

- Monetary policy decisions will be made carefully.

What This Means for Markets and Businesses

The statement from Powell is significant news as markets react to potential shifts in business news. Investors can expect a steady hand from the Fed in the face of fluctuating inflation rates and ongoing economic assessments. This cautious approach aims to stabilize both the economy and confidence in the markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.