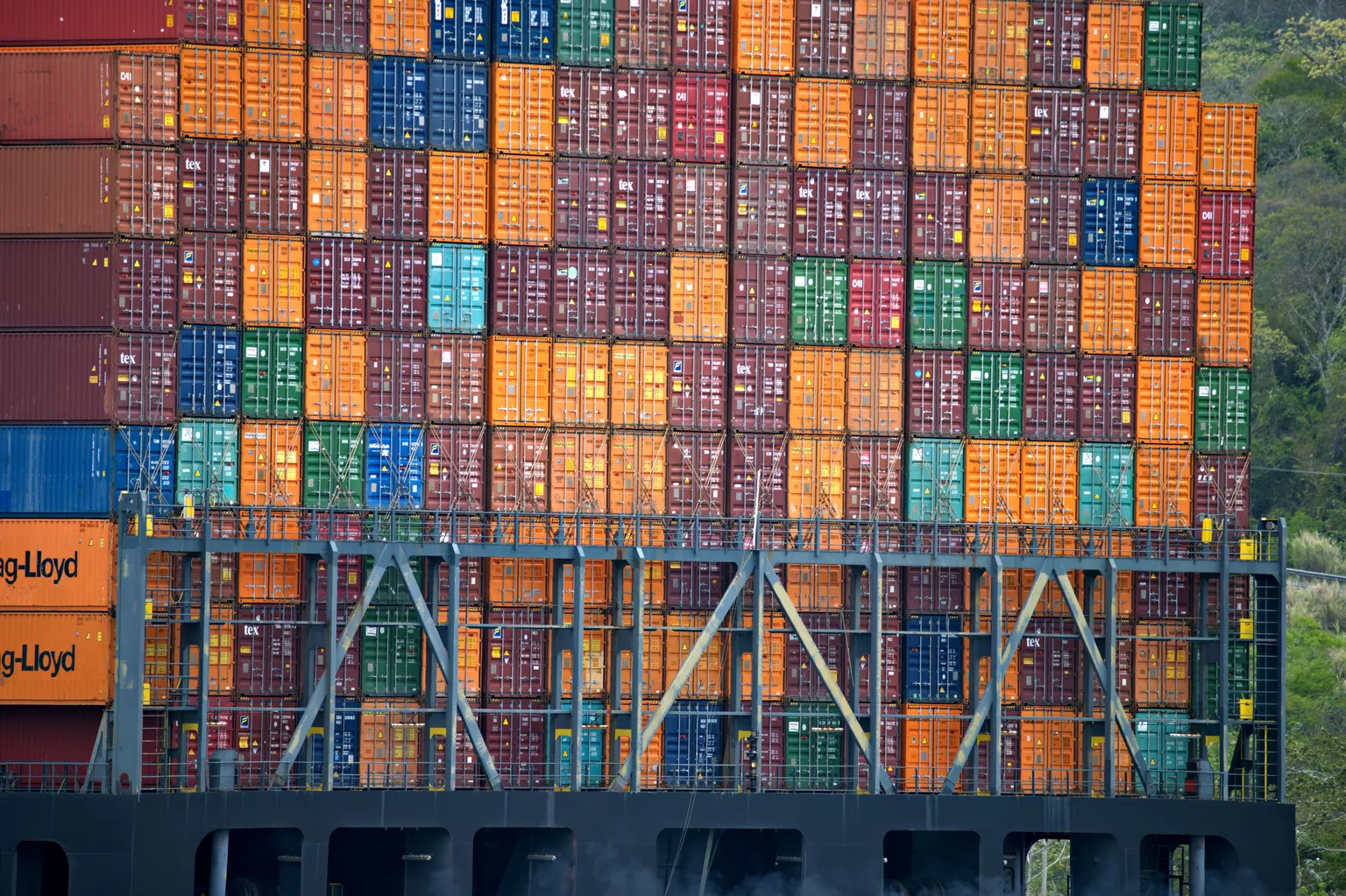

Danaos Corporation: Embracing Long-Volatility Exposure Amid Geopolitical Turbulence

Impact of Geopolitics on Danaos Corporation

Danaos Corporation has established a solid foothold in the maritime industry with its focus on long-volatility exposure. By entering into multi-year and fixed-rate charter agreements with large operators, the company positions itself favorably to weather geopolitical uncertainties. Key players in the market have noted the importance of such strategies, especially in times of global unrest.

Why DAC Stock is a Hold

Given its resilience and strategic chartering plan, DAC stock maintains a steady outlook. Investors should consider both the potential risks and rewards associated with geopolitical factors affecting maritime operations.

- Strong charter agreements

- Favorable market conditions

- Risk management strategies

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.