The Rise of Quyuan: Moore Threads Aims for IPO in Competitive AI Chip Market

The Path to Initial Public Offering for Moore Threads

Quyuan technology, established by Zhang Jianzhong, former Nvidia executive, is pushing its startup Moore Threads towards an IPO following its recent capital increase.

Funding Boost and Corporate Transformation

This Beijing-based AI chip designer's capital base surged to 330 million yuan, transitioning to a joint-stock company and setting the stage for a potential market debut.

Investor Interest and Market Position

- Moore Threads attracted substantial investments, raising over 2 billion yuan in a Series B+ funding round.

- Major investors include Houxue Capital, Pioneer Investment, and Zhejiang Century Huatong Group.

- Its valuation jumped to 77.42 billion yuan before the latest funding round.

Competing Amidst Challenges

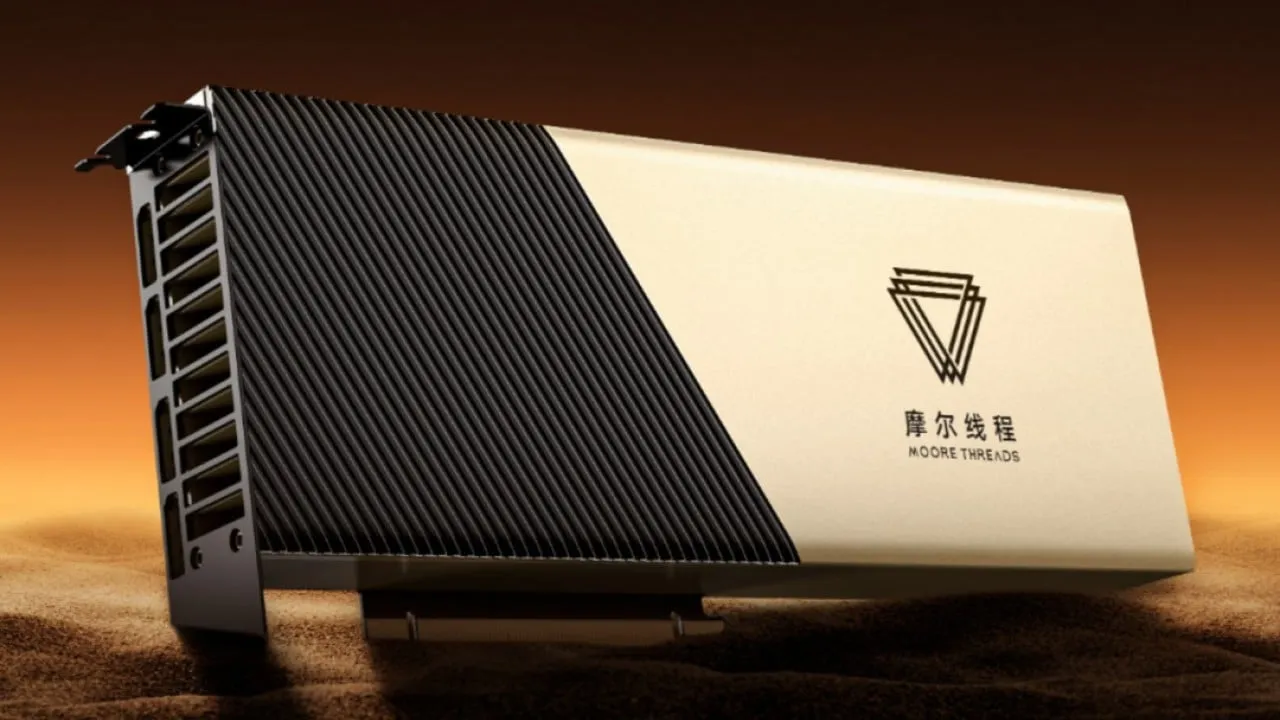

Despite sanctions affecting access to global foundries, Moore Threads has pivoted towards AI accelerators, leveraging the increasing demand for AI-specific chips, including their latest Quyuan model, launched to meet market demands for high-capacity processing.

The Competitive Landscape

If its IPO moves forward, Moore Threads will join rivals like Biren Technology in a race to solidify their standing in the semiconductor market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.