South China Morning Post: Analyze AuGroup's Hong Kong IPO and Its Growth Potential in E-commerce

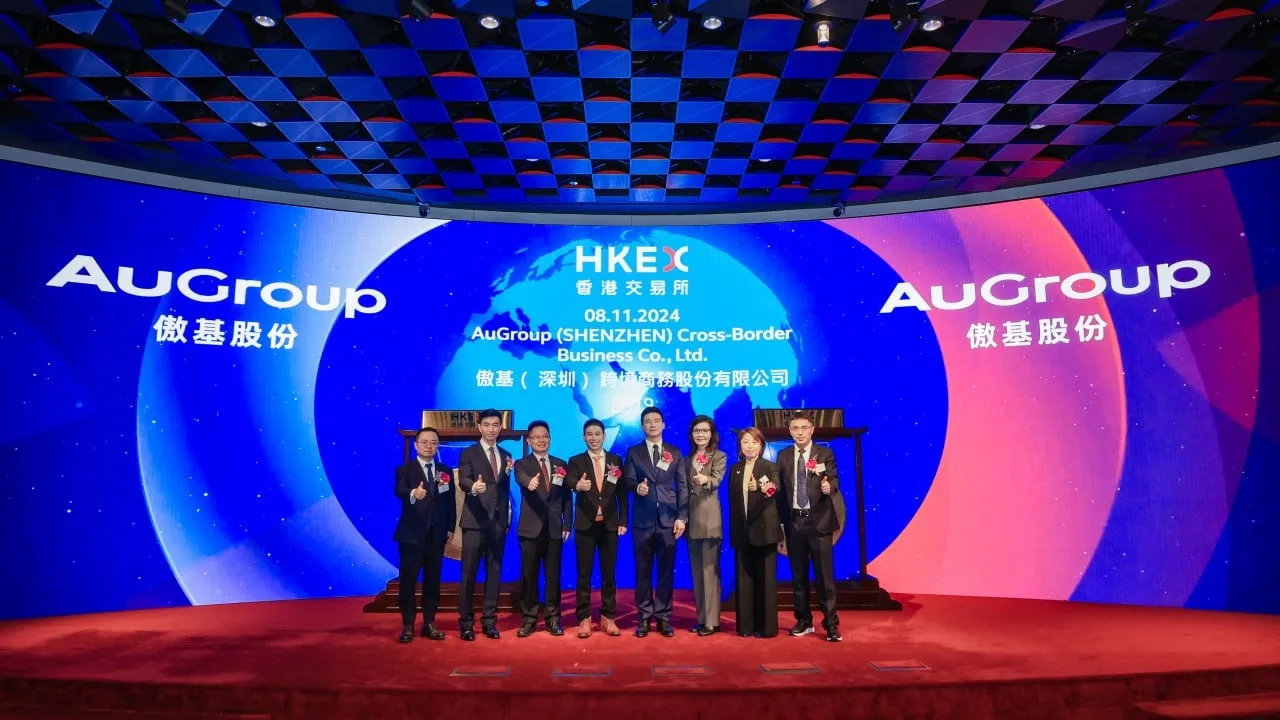

AuGroup IPO: A Landmark Event

On November 8, AuGroup (2519.HK) officially landed on the Hong Kong Stock Exchange as the first share of furniture going overseas. The IPO attracted a remarkable 17.7 times oversubscription, reflecting investor confidence in the company's growth trajectory.

Growth Potential in Cross-Border E-commerce

- AuGroup is a leader in the global cross-border e-commerce space, particularly in the furniture sector.

- In 2023, the company ranked first for GMV among China-based B2C sellers in the overseas furniture market.

- The firm has established strong logistics capabilities that enhance its competitive edge.

Strategic Strengths and Resilience

With a diverse range of exclusive brands like ALLEWIE and IRONCK, AuGroup has displayed impressive resilience, achieving a 22.3% revenue increase following market challenges and a swift recovery post the Amazon Incident.

Logistics Infrastructure: A Competitive Advantage

- AuGroup has developed a global warehousing and logistics network that emphasizes efficiency and cost-effectiveness.

- Its innovative logistics solutions have significantly reduced operational costs.

Looking ahead, AuGroup's capacity to adapt to changing market demands and expand its logistics services could yield further growth opportunities, establishing a robust presence in the global furniture market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.