Analog Devices Stock Analysis: Challenges and Opportunities Ahead

Market Dynamics for Analog Devices

Analog Devices (NASDAQ:ADI) operates in a competitive landscape with a diverse product portfolio. However, it has faced significant challenges that hinder its growth potential. Missed opportunities, particularly in high-growth sectors like electric vehicles, have raised concerns among investors.

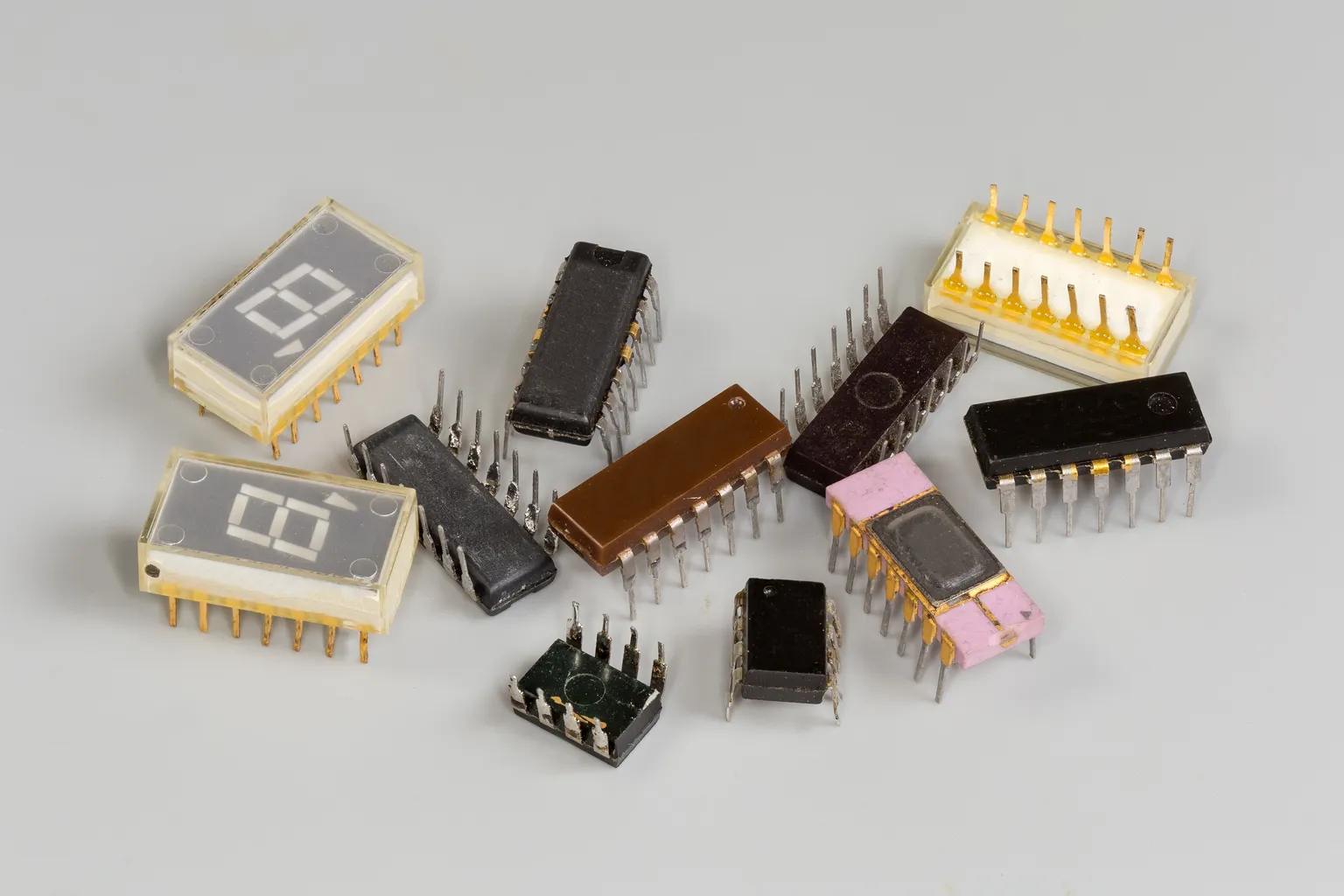

Assessing the Product Portfolio

- Wide range of products but lacks focus on high-demand areas

- Competition in the semiconductor market is intensifying

- Need for innovation to enhance market share

Investment Outlook

Investors should consider not just the current market standing of ADI stock but also its future potential. While it offers stability, the growth trajectory is under scrutiny. As market conditions evolve, ADI must adapt to seize new opportunities.

Strategic Recommendations for Investors

- Evaluate alternative investment options with higher growth potential

- Monitor industry trends for shifts that could benefit ADI

- Stay informed about quarterly earnings reports

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.