Vale Q3 Earnings: Unveiling Unexpected Successes (NYSE:VALE)

Introduction to Vale's Q3 Performance

Vale's recent quarterly report has revealed that its earnings surpassed analyst expectations, showing a remarkable ability to manage costs effectively, even as revenues faced headwinds. This performance is underscored by strategic decisions that have paved the way for long-term growth.

Earnings Analysis

The Q3 earnings report from Vale (NYSE:VALE) demonstrated unexpected strength, particularly in its operational modules which showed robust cost management. This shift has enabled Vale to maintain a solid bottom line despite revenue decreases.

Key Highlights

- Earnings Per Share (EPS): Exceeded analysts' forecasts.

- Cost Reductions: Significant reductions that contributed to profitability.

- Market Challenges: Navigating lower revenue streams effectively.

Investment Considerations

Given Vale's stronger-than-anticipated earnings and efficient cost-cutting measures, many analysts are recommending an investment in Vale shares. The combination of a resilient operational strategy and positive earnings growth positions Vale favorably for potential investors.

Final Thoughts on Vale's Future

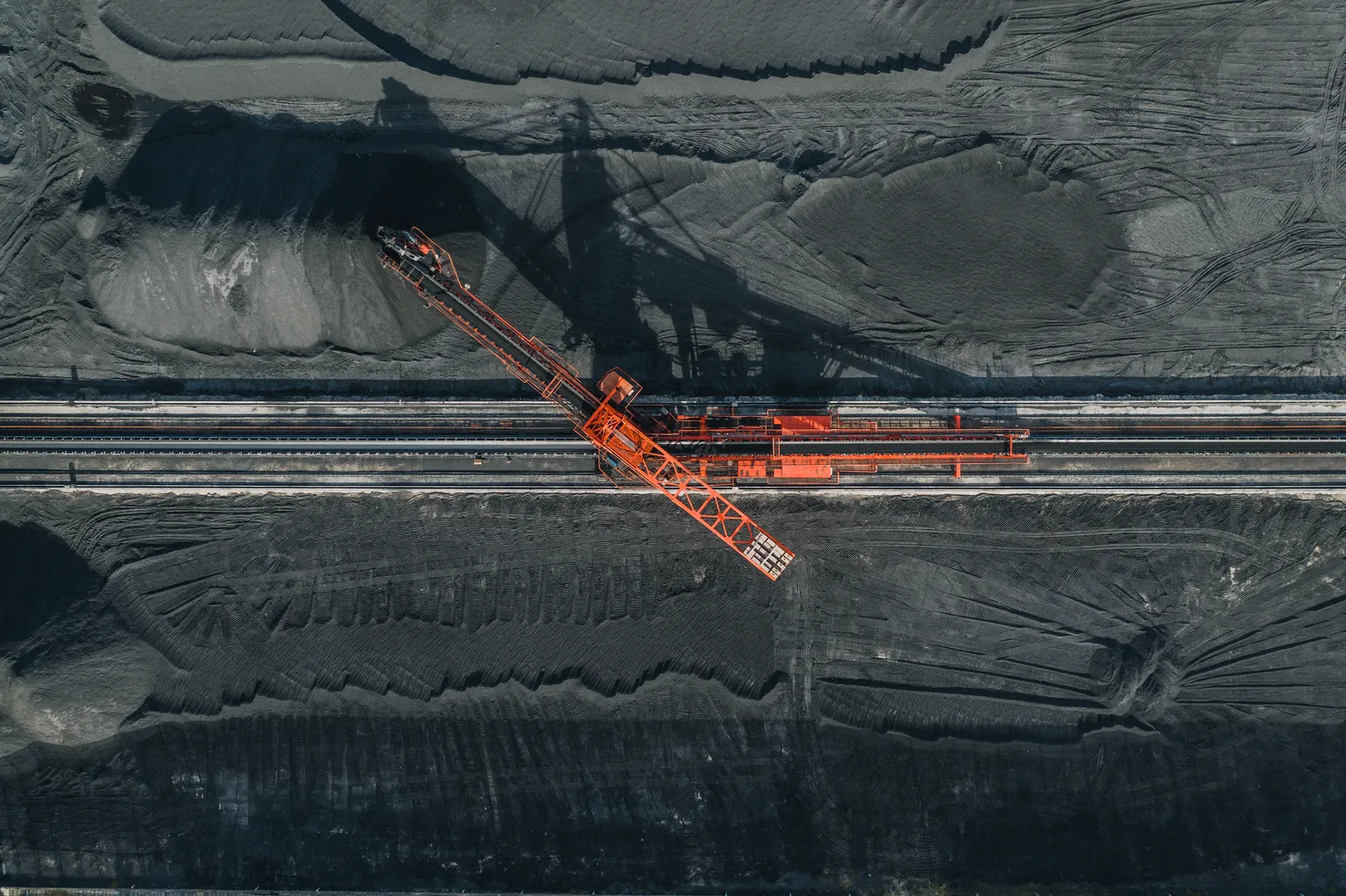

With its latest results, Vale has established a strong base for future growth. Investors looking for opportunities in the mining sector should consider Vale as a viable candidate given its committed approach to cost efficiency and its flexibility in adapting to changing market dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.