The Necessity of the Fed to Raise its Long-Term Target for a Soft Landing

Friday, 7 June 2024, 11:30

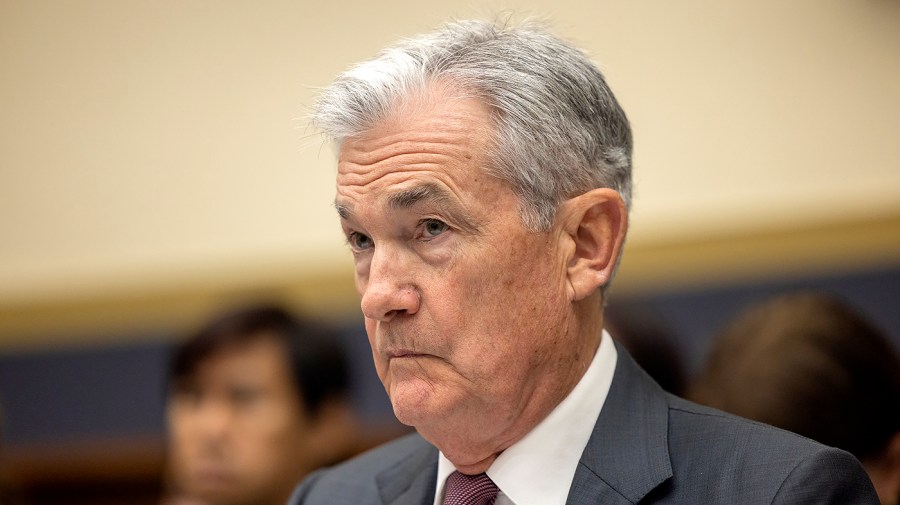

The Federal Reserve's Crucial Decision

In the midst of economic uncertainties, the Federal Reserve faces mounting pressure to adjust its long-term interest rate target. The decision is pivotal in determining the trajectory of the economy and financial markets.

Implications for Various Sectors

- Stock Market: Investors brace for potential shifts and fluctuations in stock prices.

- Real Estate: Homebuyers and industry experts closely monitor mortgage rates and housing market trends.

It is crucial for the Fed to act decisively and responsibly to steer the economy towards a stable and positive direction.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.