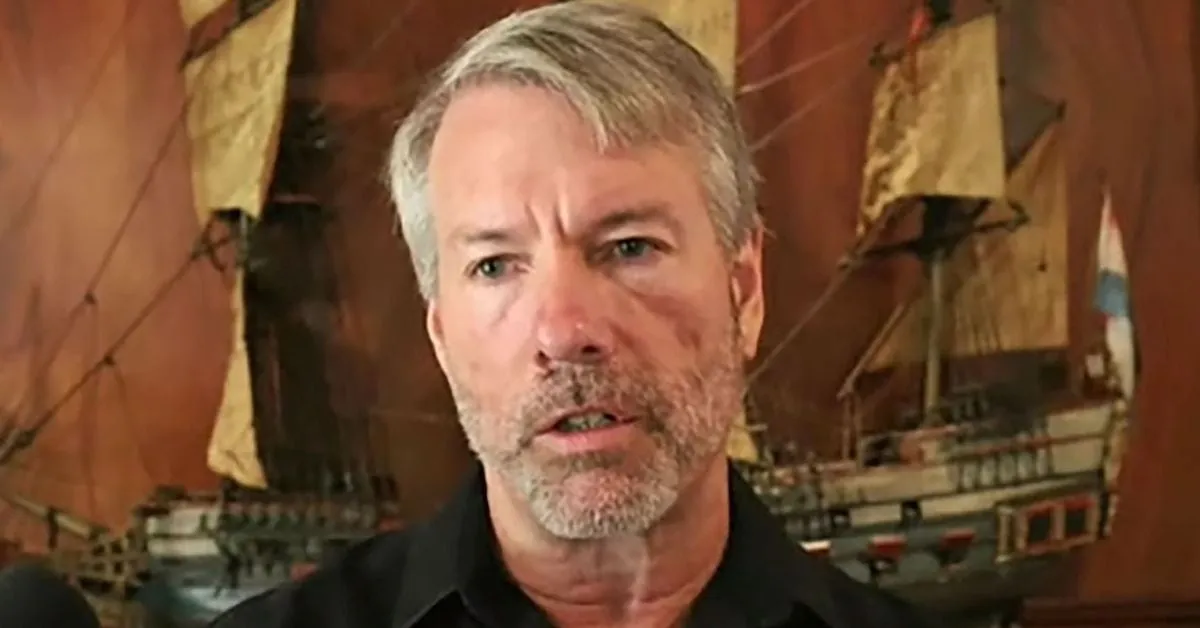

Bitcoin Analysts Discuss Risks in MicroStrategy's Ambitious $42B Acquisition Plan

Bitcoin Analysts Raise Concerns Over MicroStrategy's $42B Plan

Bitcoin analysts are sounding the alarm on MicroStrategy's ambitious $42 billion acquisition strategy. According to a report from CoinShares, several critical factors will influence the implementation of this plan.

Key Risks Identified by Analysts

- Financing Conditions: Analysts emphasized that financing conditions need to remain favorable for MicroStrategy to execute its plan without stumbling.

- Investor Demand: Continuous demand from investors for the firm’s convertible debt is essential for long-term viability.

- Bitcoin Market Volatility: Fluctuations in the bitcoin market could affect the feasibility of the acquisition.

The Bigger Picture

As analysts from CoinShares highlight, investor sentiment and market dynamics will play a pivotal role in determining the success of MicroStrategy's ambitious endeavors in the cryptocurrency domain.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.