ASM International's Solid Growth Outlook Reinforces Buy Rating (OTCMKTS:ASMIY)

ASM International's Growth Trajectory: An Overview

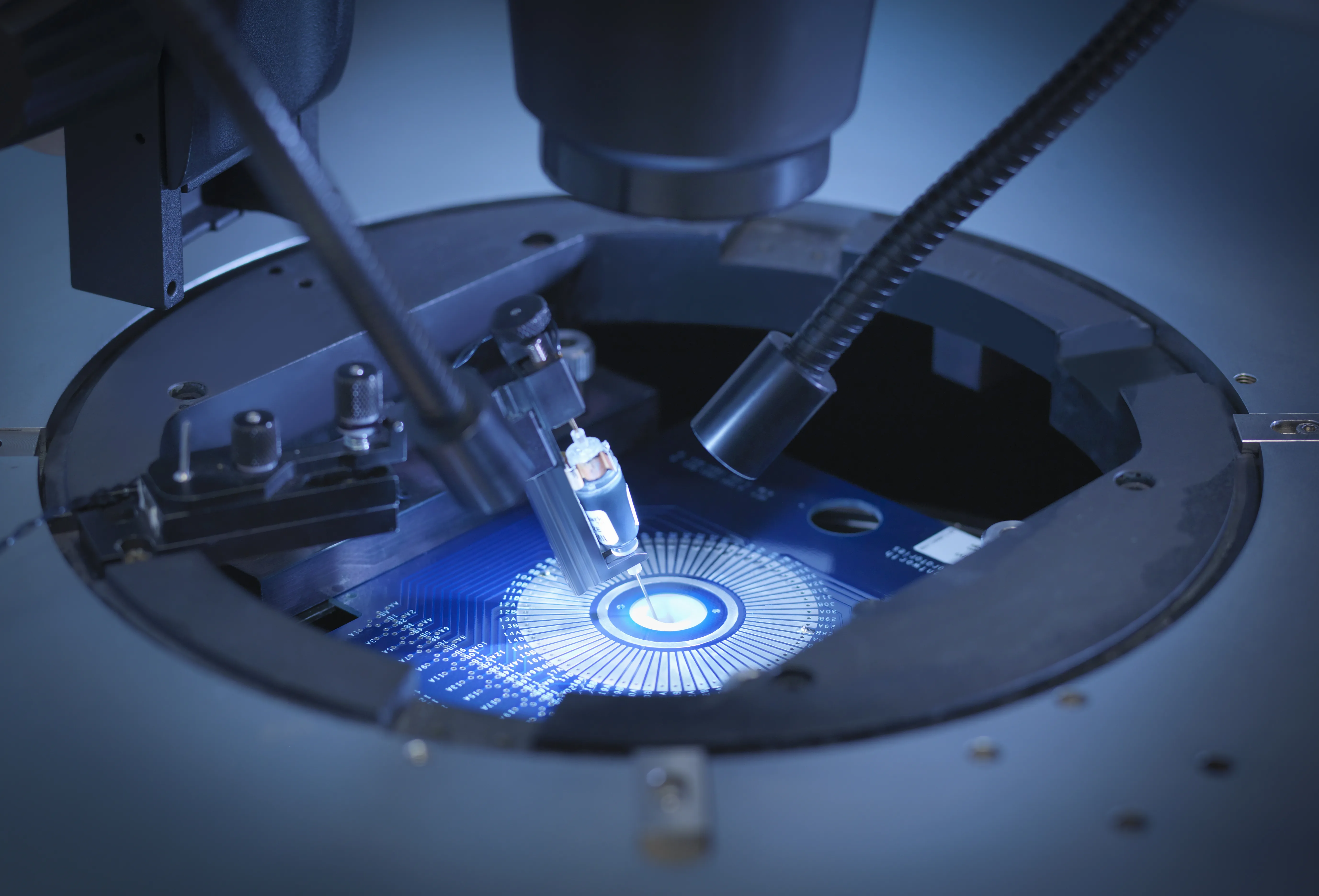

ASM International (ASMIY) showcased strong 3Q24 results, showcasing a solid growth outlook. This is largely driven by b>robust demand for GAA and HBM technologies, which have emerged as critical sectors in the semiconductor industry.

Key Financial Metrics

- Revenue Growth: The company reported impressive increases in revenue, indicating a healthy demand pipeline.

- Profit Margins: Improved profit margins reflect effective cost management.

Market Trends

The semiconductor sector is witnessing shifting dynamics, with an increasing focus on advanced technologies. ASM International is well-positioned to capitalize on these trends due to its innovative product offerings.

Investment Considerations

- Strong Demand: The ongoing demand for GAA and HBM technologies makes ASMIY a strong candidate for investment.

- Long-term Strategy: The company's strategic focus aligns with the future needs of the industry, enhancing its growth prospects.

In summary, ASM International's performance and strategic direction justify maintaining a buy rating. Future-oriented investors may find significant opportunities in ASMIY.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.