STAG Industrial's Q3 Report Reaffirms Its Position as a Strong Investment

STAG Industrial's Q3 Earnings Overview

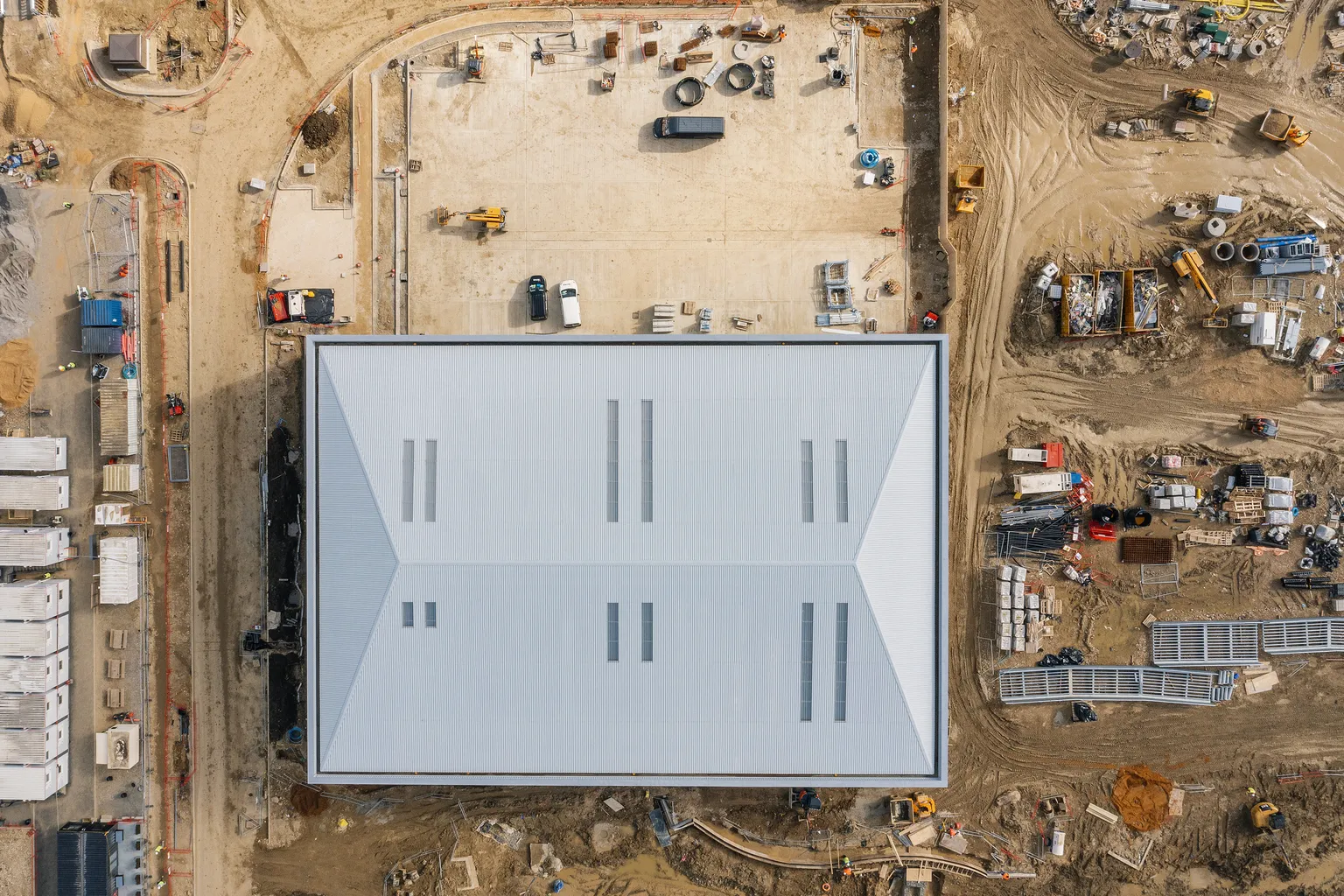

STAG Industrial presented impressive financial metrics in its latest earnings report, highlighting a consistent performance in property acquisitions and portfolio expansion. The Q3 results indicate strong demand for industrial real estate, reflecting overall economic growth.

Key Financial Highlights

- Earnings Per Share (EPS) exceeded analyst expectations.

- Occupancy rates remained steady at an impressive 97%.

- Year-on-Year Revenue Growth indicates strong demand in the industrial sector.

Why STAG Remains a Buy

Investors looking for reliable income sources should consider STAG Industrial due to its robust business model. The company’s strategic positioning in the market allows for consistent cash flows and potential upside. With strong financial health and growth prospects, STAG Industrial appeals to a diverse investor base focused on sustainability and returns.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.