Democrats' Stock Returns Lead Republicans Amid Election Insights

Stock Performance Analysis by Political Party

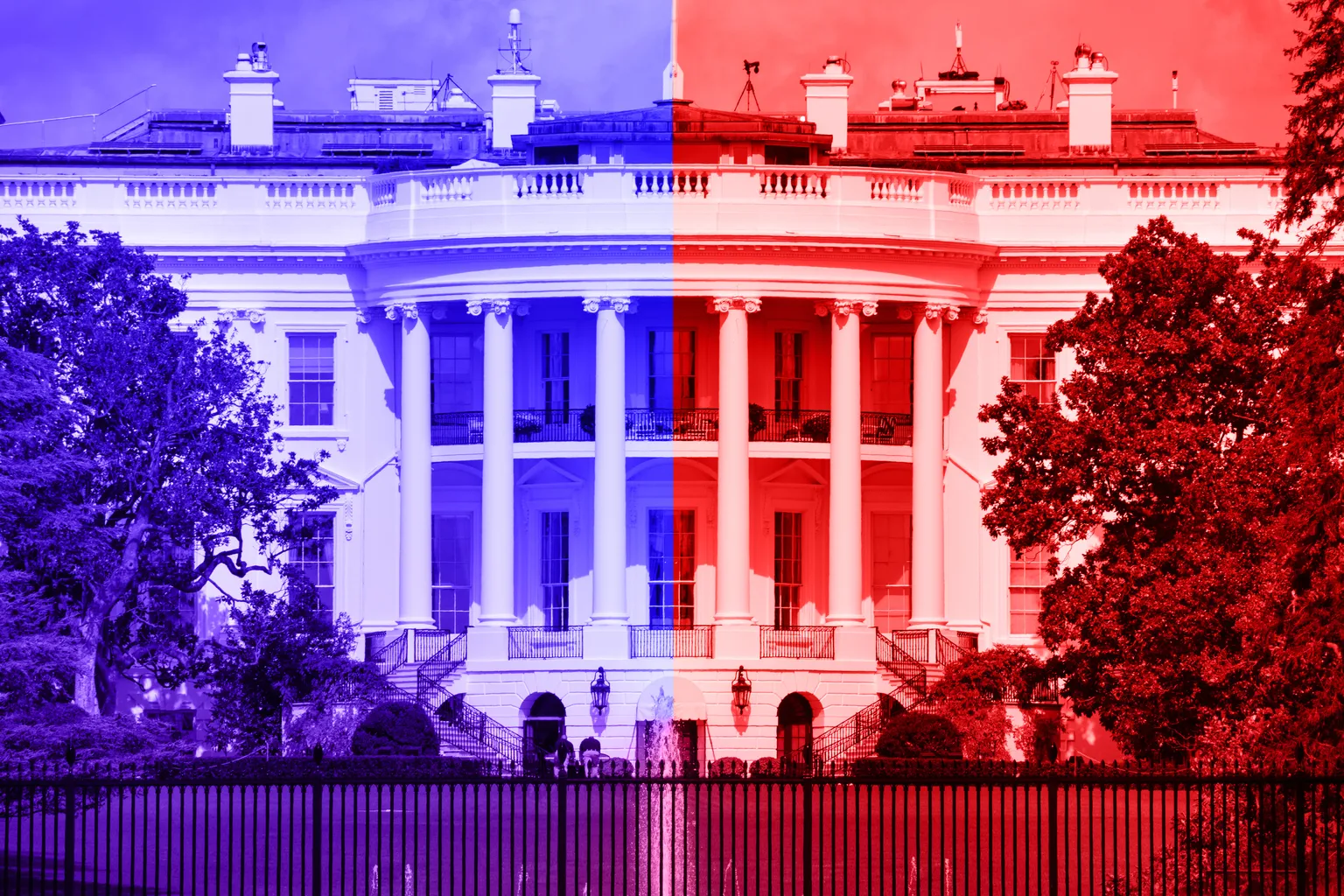

The financial market has often reflected political dynamics, with stock returns varying under different administrations. Recent data shows that Democrats' stock returns typically outperform those of Republicans. However, this raises an important question: does it truly influence economic strength? Regardless of who occupies the White House, the broader economic conditions often dictate outcomes.

The Resilience of the U.S. Economy

The U.S. economy is profoundly resilient. Political leadership may influence various aspects, but key economic indicators highlight that investors should consider broader market patterns rather than solely focusing on the political landscape. Election investments should take into account the fundamentals that drive the market.

Strategic Investment Insights

- Long-Term Growth vs. Political Shifts: Investors are encouraged to prioritize assets that promise long-term growth over speculative political plays.

- Understanding Economic Cycles: Recognizing how economic cycles operate can help navigate periods of uncertainty.

- Investing Wisely During Elections: Different sectors may perform variably based on election outcomes, making sector analysis critical.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.