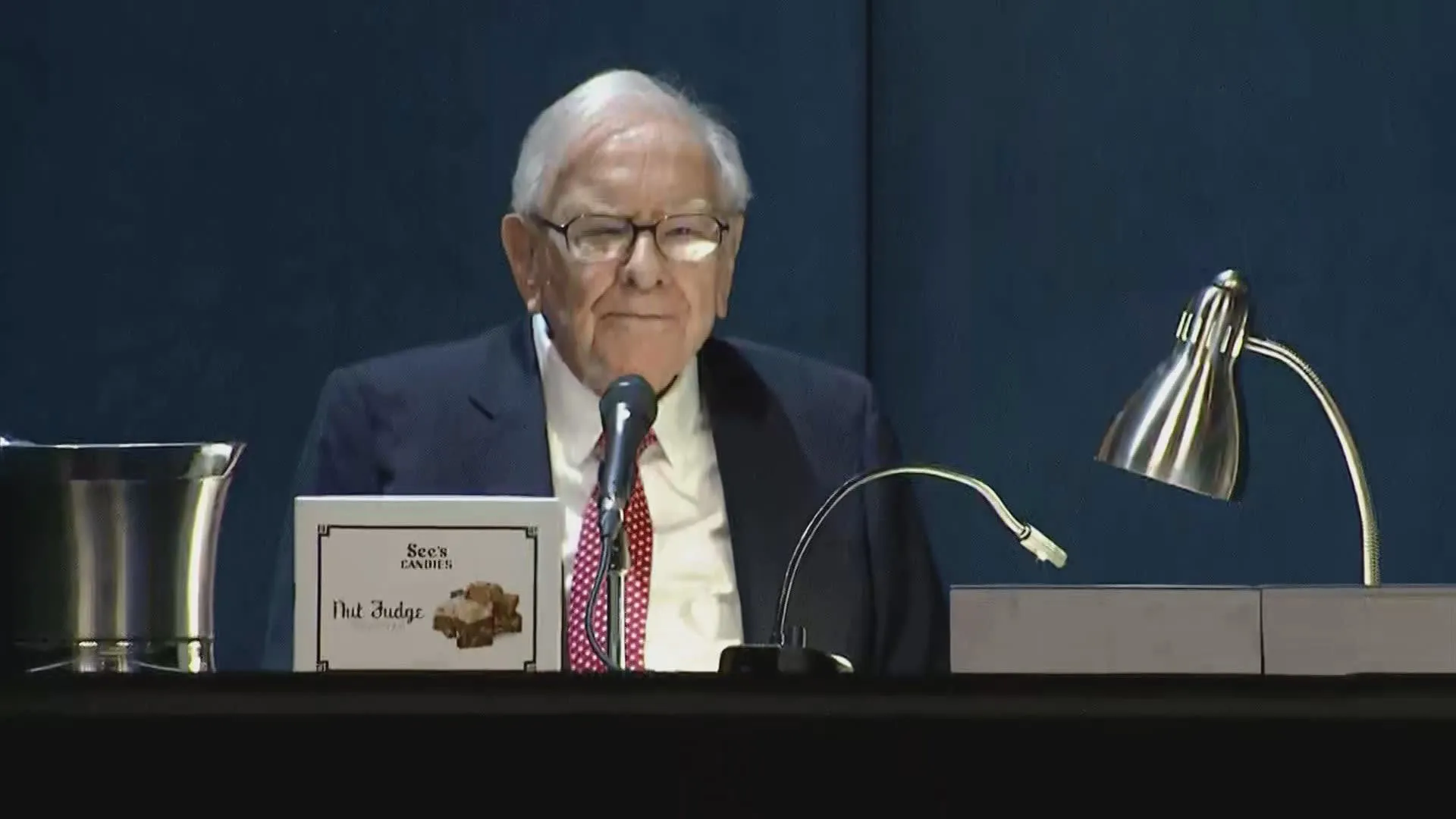

Berkshire Hathaway Inc: Why Warren Buffett is Shunning Stocks, Including His Own

Berkshire Hathaway Inc's Stock Market Strategy

Berkshire Hathaway Inc has seen a critical turn in its leadership's investment approach. Warren Buffett, the famous CEO, seems to be shunning stocks, including significant holdings. This article discusses three core reasons behind this cautious stance.

1. Concerns Over Major Corporations

Buffett has expressed unease regarding companies like Nike Inc, Goldman Sachs Group Inc, and Coca-Cola Co. These concerns have prompted a strategic reassessment of stock investments.

2. Market Volatility

As global stock markets display heightened volatility, Buffett's strategies reflect a defensive posture. This approach may help mitigate risks in a fluctuating economic environment.

3. Speculation in Tech Giants

Given the current climate surrounding tech companies such as Apple Inc, many investors, including Buffett, seem to be pulling back. This indicates a more conservative investment strategy amidst uncertainty.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.