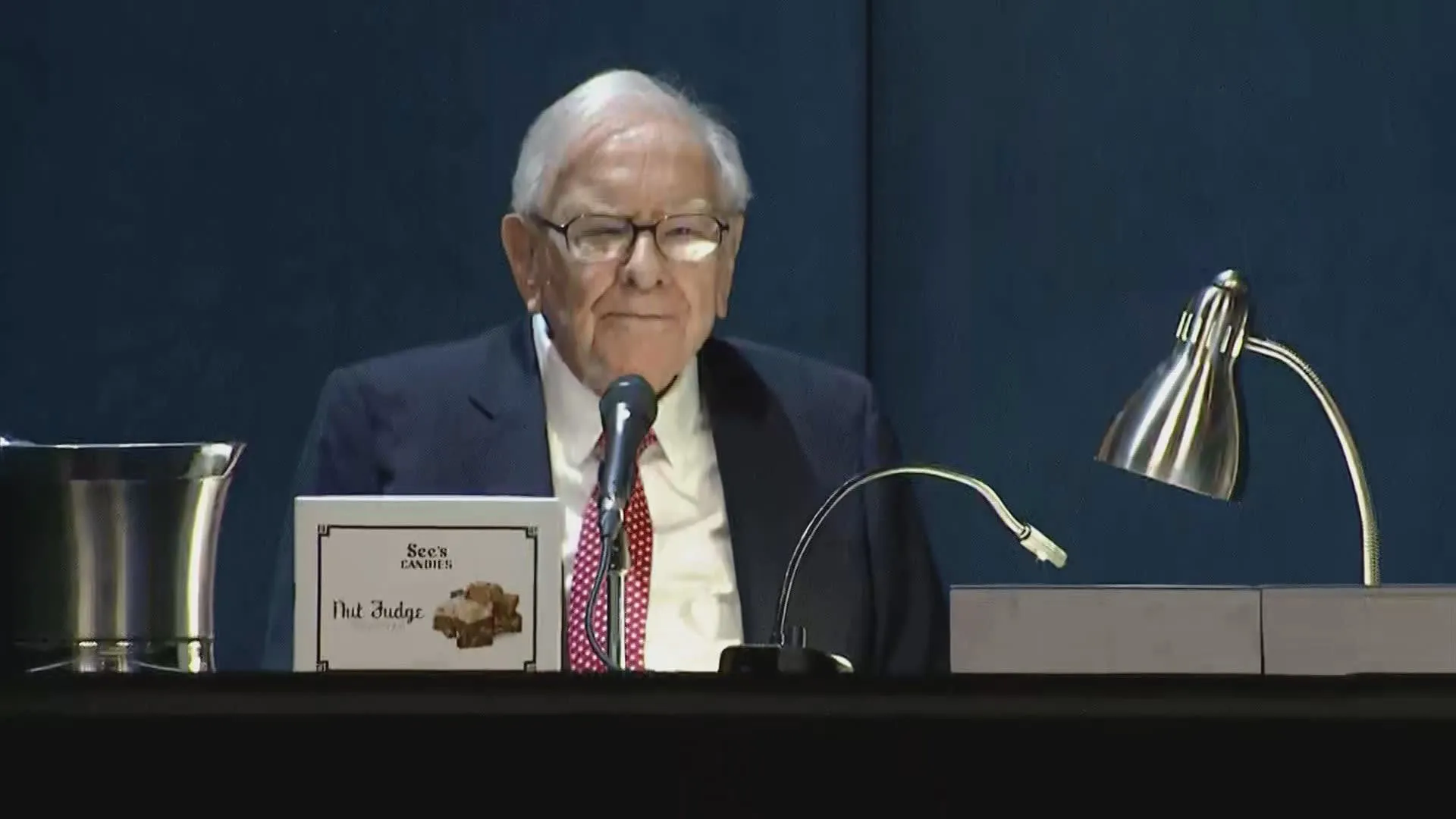

Warren Buffett Sells Apple Inc Stake: Implications for Stock Markets and Wall Street

Warren Buffett's Strategic Move

Warren Buffett has recently announced that he has sold a substantial portion of his Apple Inc stake, cutting his holdings by around a quarter during the third period. This marks the fourth consecutive quarter in which the Oracle of Omaha has downsized this significant investment.

Analysis of Apple's Role in Berkshire Hathaway Inc's Portfolio

As Berkshire Hathaway Inc's most significant equity holding, Apple's performance plays a crucial role in the company's overall financial health. This decline in Buffett’s stake raises pivotal questions regarding his investment strategy and how it may reflect larger market trends.

Impact on Stock Markets

- The reduction in Apple's stock may indicate shifting priorities within Wall Street as analysts reassess tech market dynamics.

- Buffett's actions could signal a broader market sentiment, influencing investment strategies across various sectors.

Key Takeaways

Investors of all types should stay attuned to these developments as they might shift the contours of investment strategies moving forward.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.