SPMC CEF: Assessing the Right Time for Preferred Shares Over Leverage

Saturday, 2 November 2024, 08:50

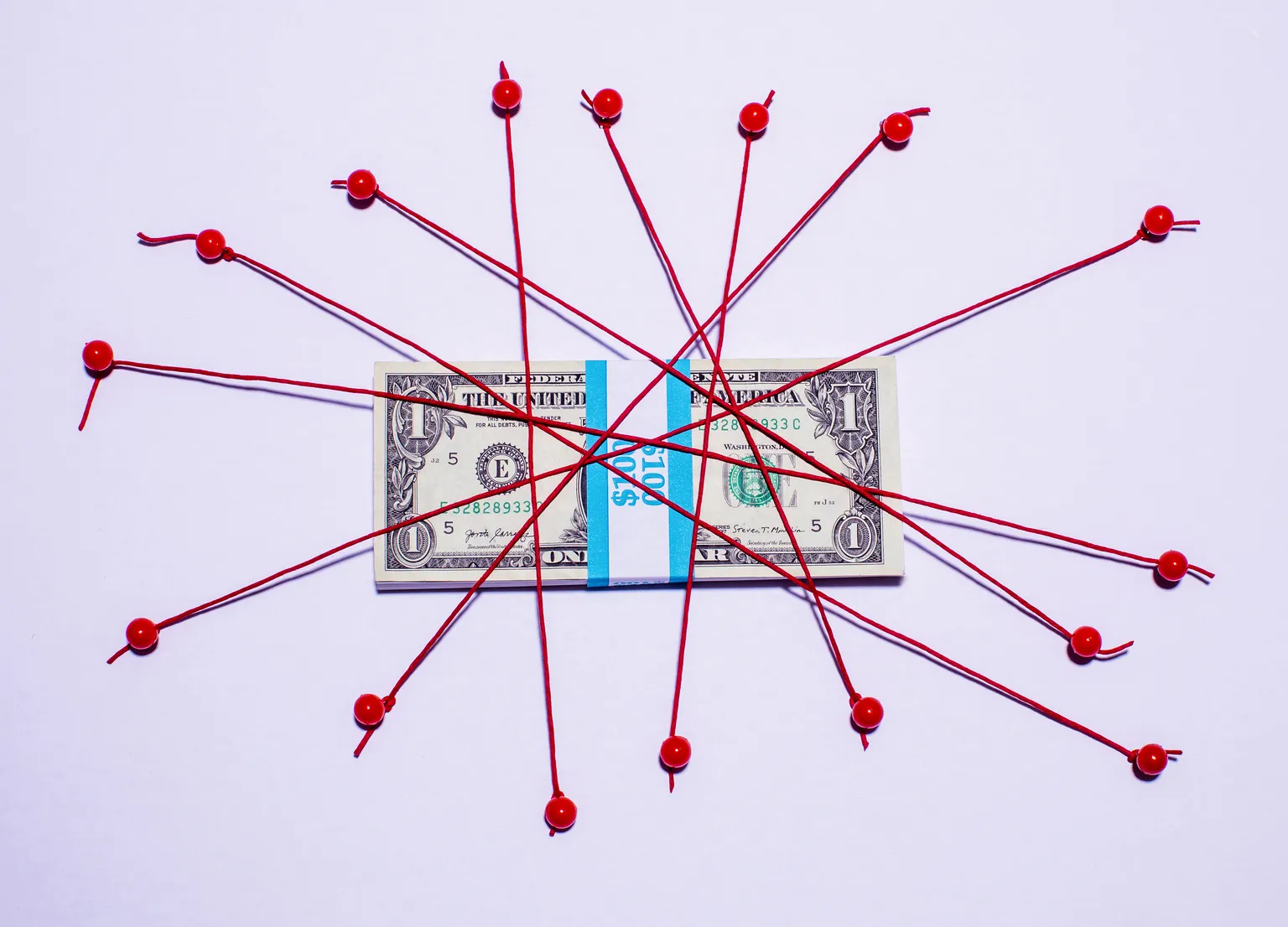

Preferred Shares vs. Leverage in SPMC CEF

SPMC CEF serves as a notable player in the investment landscape, primarily investing in CLO equity tranches. In recent evaluations, it becomes clear that leveraging up does not present the most favorable option for investors right now. Instead, preferred shares offer a more secure and lucrative opportunity.

Investment Insights

- Market Conditions: Current financial markets indicate heightened volatility.

- Potential Risks: Leverage may amplify losses during downturns.

- Preferred Shares Performance: These instruments maintain stability and yield attractive returns.

Strategic Recommendations

- Focus on quality preferred shares to enhance portfolio resilience.

- Monitor CLO market dynamics for informed investment decisions.

- Re-evaluate leverage strategies in light of evolving market conditions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.