Understanding Freeport-McMoRan: A Value Proposition in Commodity Markets

Freeport-McMoRan's Market Resilience

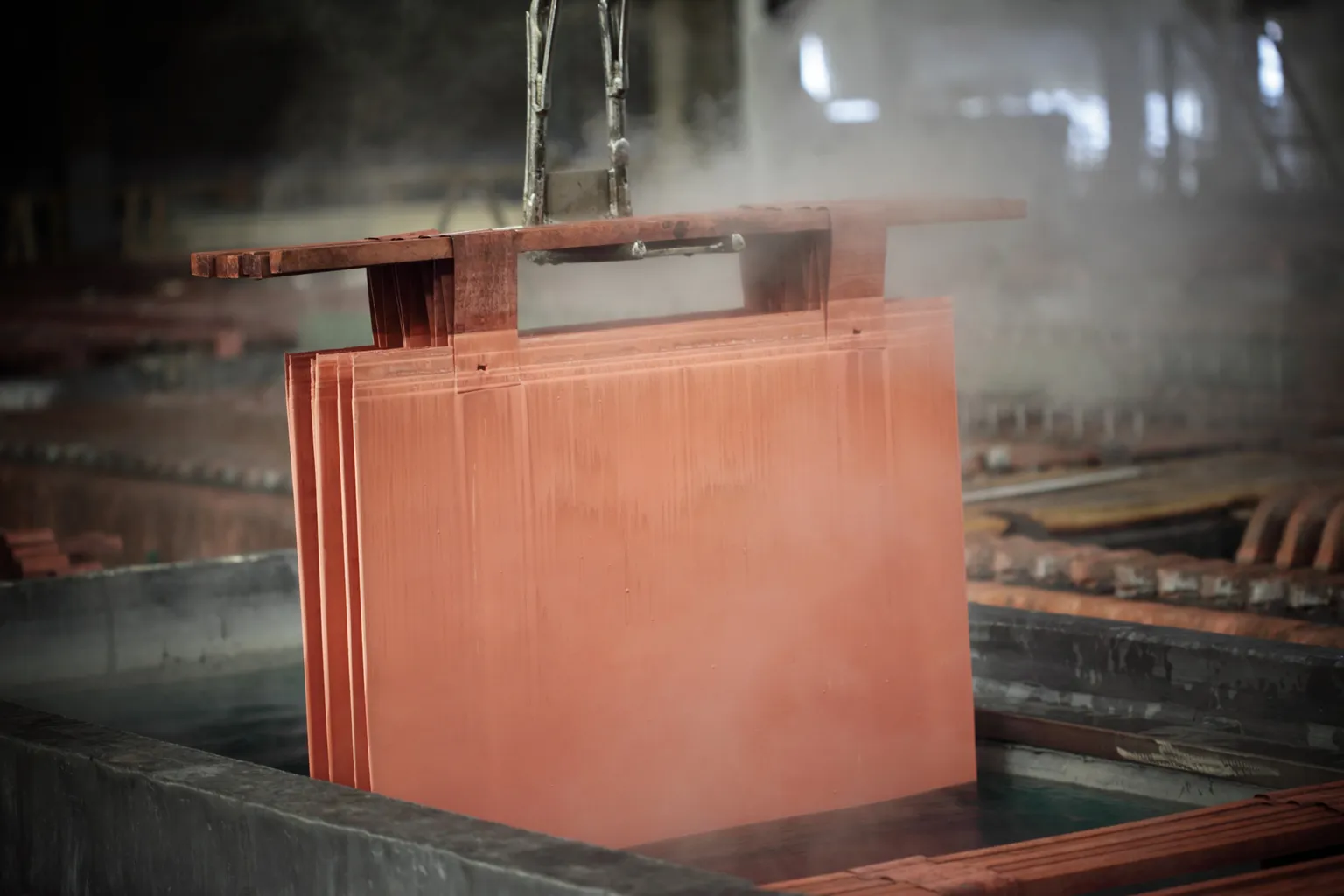

Freeport-McMoRan (NYSE: FCX) stands out due to its quality assets and significant financial flexibility. With low debt levels and a strong ability to generate operating cash flow, FCX is well-placed to weather volatility in commodity markets.

Strategic Financial Management

- Low Debt Levels: This is crucial for mitigating risk during downturns.

- High Operating Cash Flow: A key indicator of financial health.

- Diversified Assets: Provides stability across fluctuating market conditions.

Valuing FCX: What Investors Should Consider

Investors contemplating a purchase should prioritize understanding the intrinsic value of FCX, rather than chasing short-term fluctuations. With a robust asset portfolio, FCX presents opportunities for long-term growth.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.