Bitcoin's Drop Triggers Panic Sales Among Short-Term Holders

Bitcoin's Market Reaction

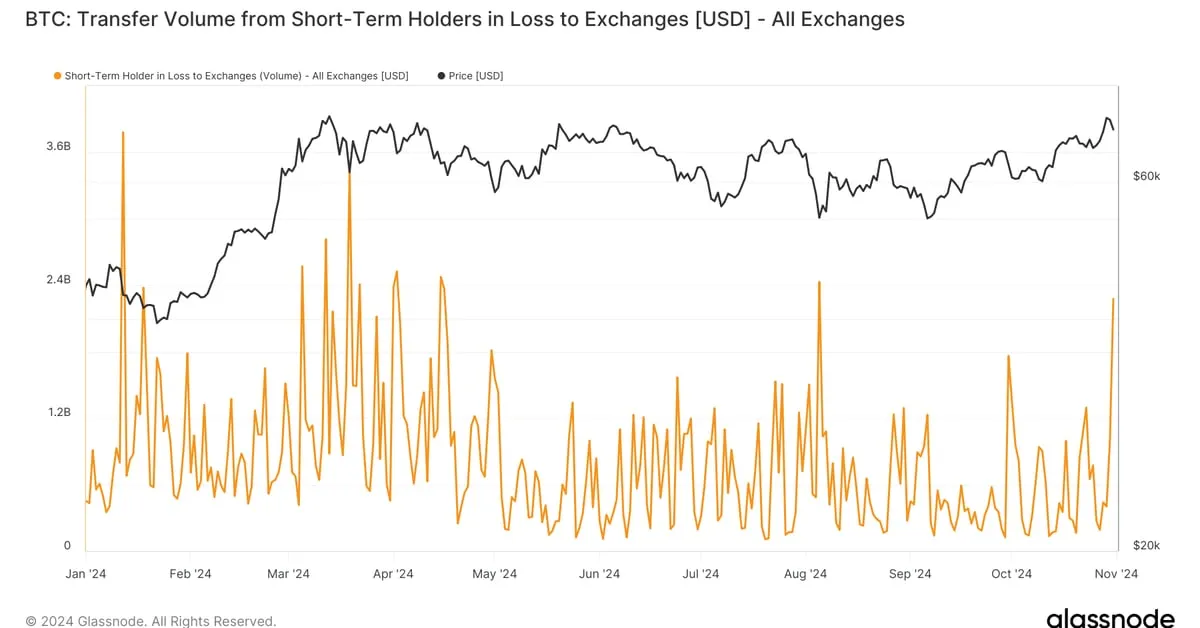

In a surprising turn, bitcoin's price fell below $70,000, leading to a frenzy of panic sales. This massive drop resulted in over $2 billion of BTC being sent to exchanges at a loss, the highest amount since August's yen carry trade unwind.

Implications for Short-Term Holders

Short-term holders are now assessing short-term buying opportunities amidst these volatile conditions. While many are exiting the market, some are positioning themselves for potential rebounds.

Market Strategies

- Evaluate your investment strategy based on the latest market trends.

- Consider diversifying into stable assets during high volatility.

- Monitor price movements closely to identify optimal buying points.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.