VIOV: Small-Cap Value Is Poised for Growth in Today’s Market

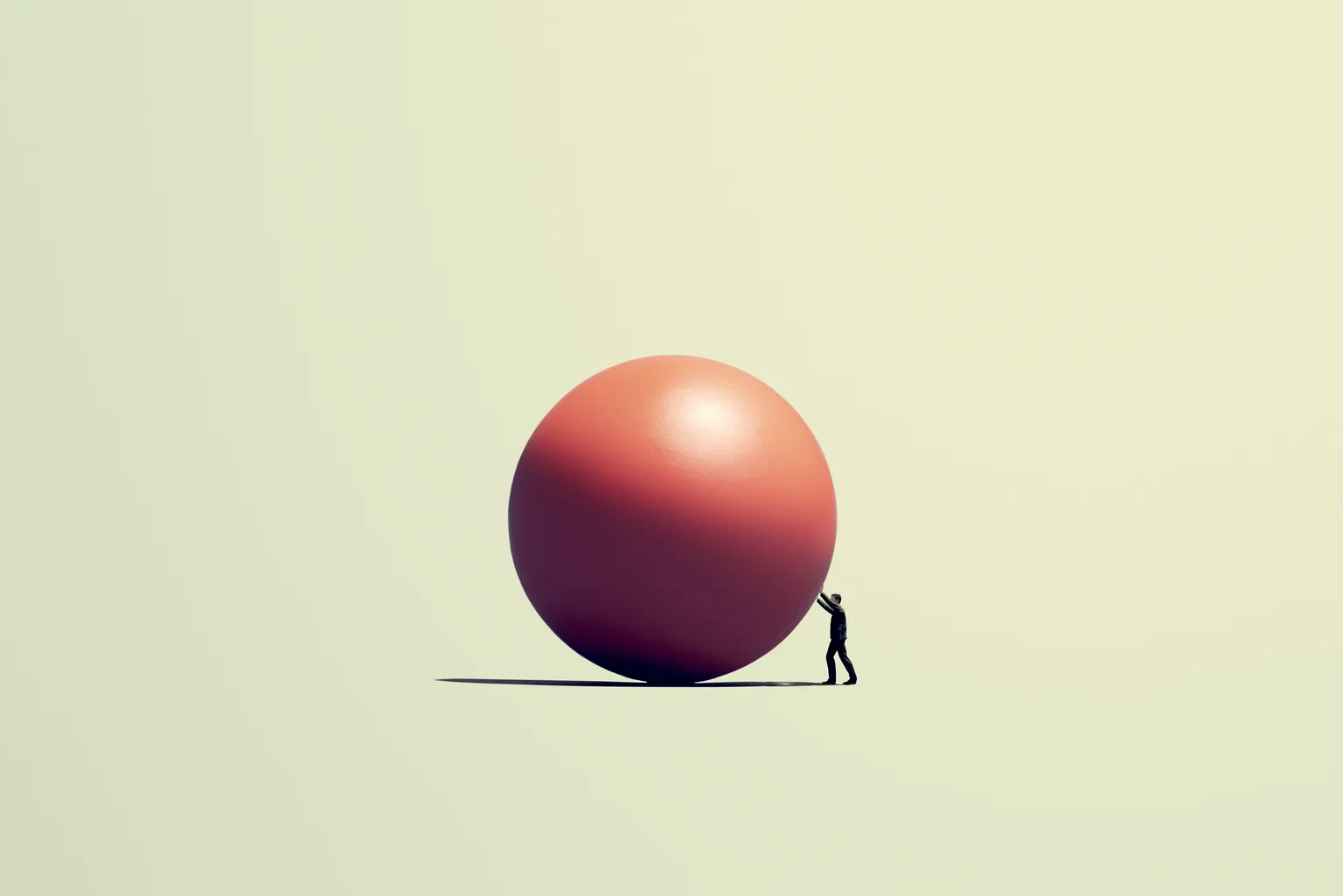

Why VIOV Is Set to Outperform

Investing in VIOV, the Vanguard S&P Small-Cap 600 Value Index Fund, offers a strategic advantage. With the financial landscape shifting, small-cap value stocks are likely to emerge as frontrunners. Investors should consider reallocating to this fund for optimal exposure to growth opportunities.

Key Advantages of Small-Cap Value Investing

- Undervalued Stocks: Small-cap value stocks often trade below their intrinsic value.

- Growth Potential: These stocks have the capacity for substantial growth compared to larger companies.

- Diversification: Including small-caps in a portfolio enhances overall investment diversity.

Market Trends Influencing VIOV

The overall market signals an impending rise in small-cap valuations. Economic indicators suggest that as the recovery continues, small companies will benefit significantly, making VIOV a core holding. Position yourself to leverage these trends effectively!

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.