AI and Operational Resilience Take Center Stage Following Global Outage

Lessons from the CrowdStrike Outage

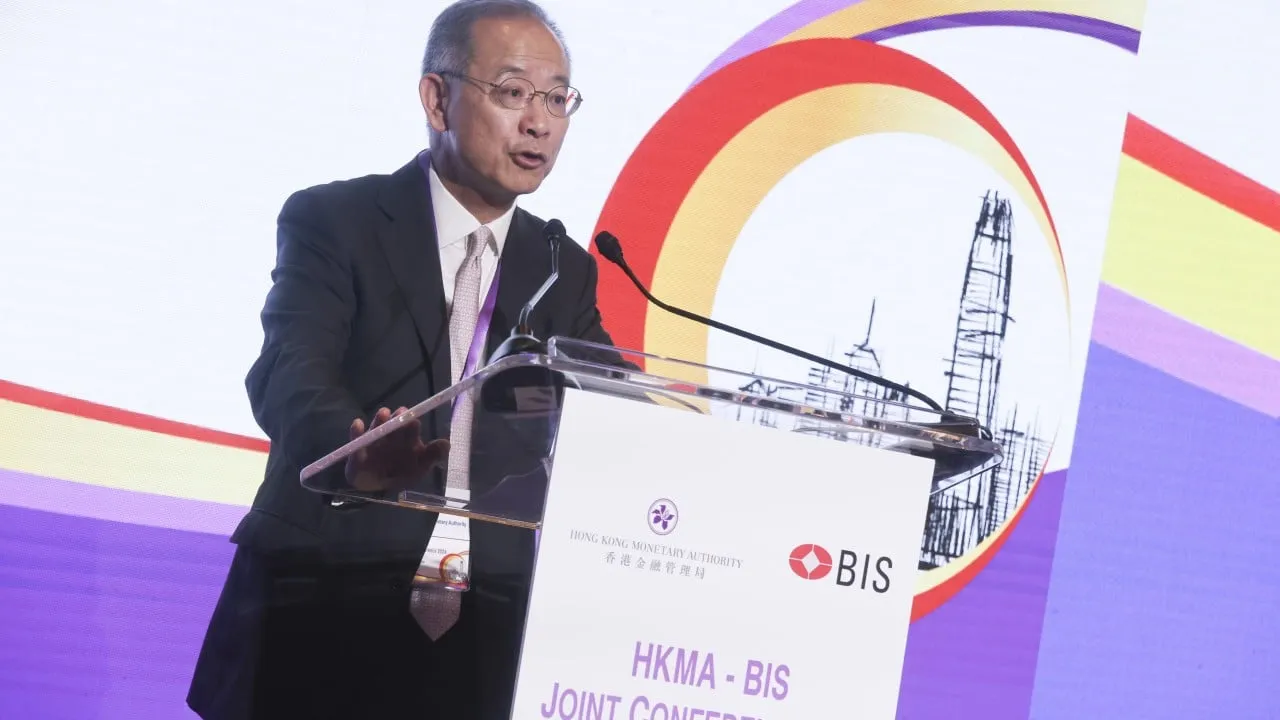

The recent mass computer outage attributed to Microsoft’s third-party provider, CrowdStrike, has sparked a critical conversation among financial leaders about the role of AI and cloud computing in today's financial landscape. During a significant conference in Hong Kong, central bankers and tech executives highlighted the urgent need to reassess their current dependency on technology vendors. Eddie Yue Wai-man, CEO of the Hong Kong Monetary Authority, noted the potential catastrophic consequences if these few powerful service providers experience IT failures or cyberattacks.

Understanding Third-Party Risks

- Operational resilience must prioritize third-party risk management.

- Firms should conduct thorough risk assessments of their AI service providers.

- James Elwes from HSBC stresses identifying concentration risks as crucial.

Collaborative Solutions Moving Forward

Experts like Balbir Bakhshi advocate for enhanced regulations and public-private partnerships to better manage these risks. They propose that clear regulatory standards will facilitate smoother operations and resource allocations for financial institutions, while maintaining the benefits of vendor concentration.

Bank of England's Stance on AI Integration

As the reliance on AI grows in areas such as credit risk assessment and algorithmic trading, Sarah Breeden, deputy governor at the Bank of England, insists on a stronger grasp of challenges by financial institutions. Guidelines from the Hong Kong Monetary Authority reinforce the necessity for a strategy in the implementation of AI technologies across the sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.