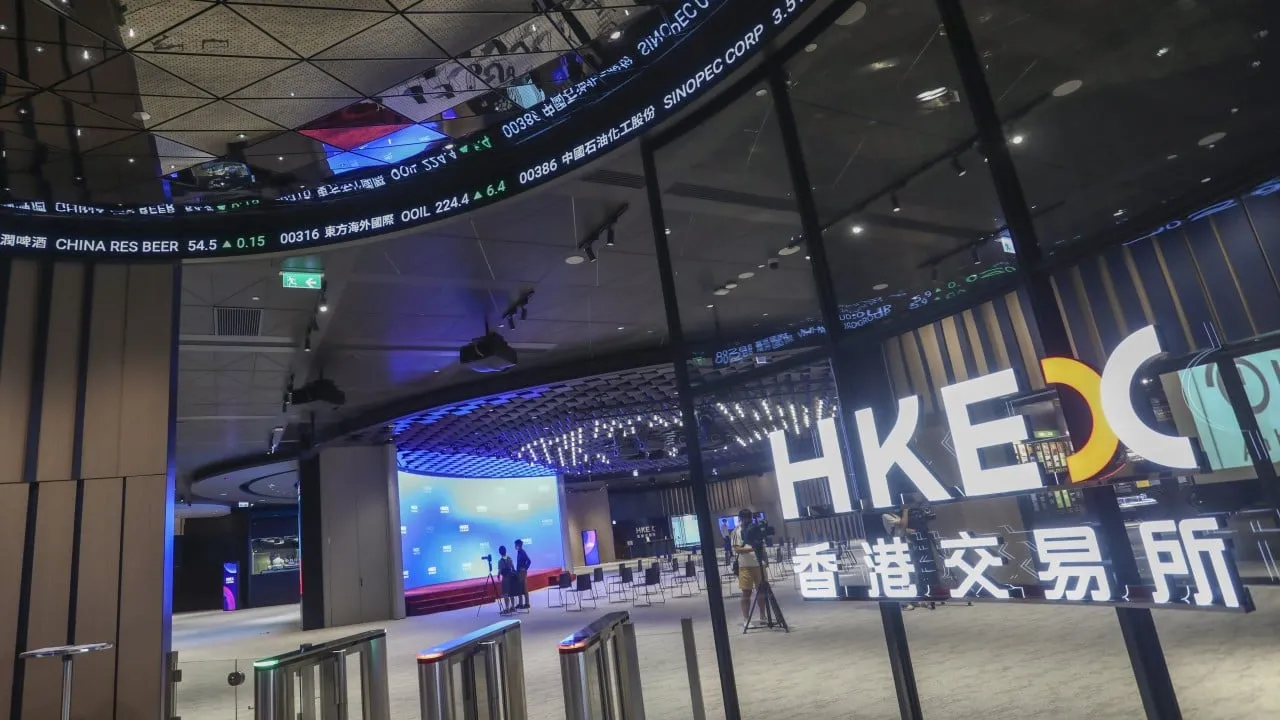

Gateway to Connectivity: HKEX Plans Saudi Office to Strengthen ESG and Sharia Investment Ties

HKEX Expands into Saudi Arabia

Hong Kong Exchanges and Clearing (HKEX) is embarking on a new initiative by opening an office in Saudi Arabia next year, a strategic decision aimed at enhancing its role within the vibrant Middle East market. This significant step reinforces HKEX's ambition to strengthen connectivity in financial markets between mainland China and the Middle East.

Strategic Commitment to Capital Market Connections

Located in the capital Riyadh, this new office will provide on-the-ground support to local investors, facilitating their access to Hong Kong's diverse financial products, including ETFs. CEO Bonnie Chan Yiting noted this initiative marks the first phase of elevating HKEX's presence in this fast-growing region.

- New office to boost regional investor access.

- HKEX's engagement with Saudi Tadawul Group.

- Launch of largest Saudi-focused ETF compliant with Sharia by Albilad Capital and CSOP.

Impact of China-Middle East Relations

As relations between China and the Gulf Cooperation Council members strengthen, HKEX’s role in fostering capital connectivity is critically important. Recent partnerships with regional exchanges demonstrate a commitment to mutual growth and innovation.

- Collaboration with multiple bourses in the Middle East.

- Enhancing fintech and cross-listing opportunities.

- Attracting investments from Middle Eastern startups.

In summary, HKEX's expansion signals the increasing importance of the Middle East in the global financial landscape, particularly concerning ESG and Sharia-compliant investments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.