Beijing's Economic Slowdown Threatens China's Copper Prices and Steel Mills

The Impact of Beijing's Economic Slowdown on China's Steel and Oil Industries

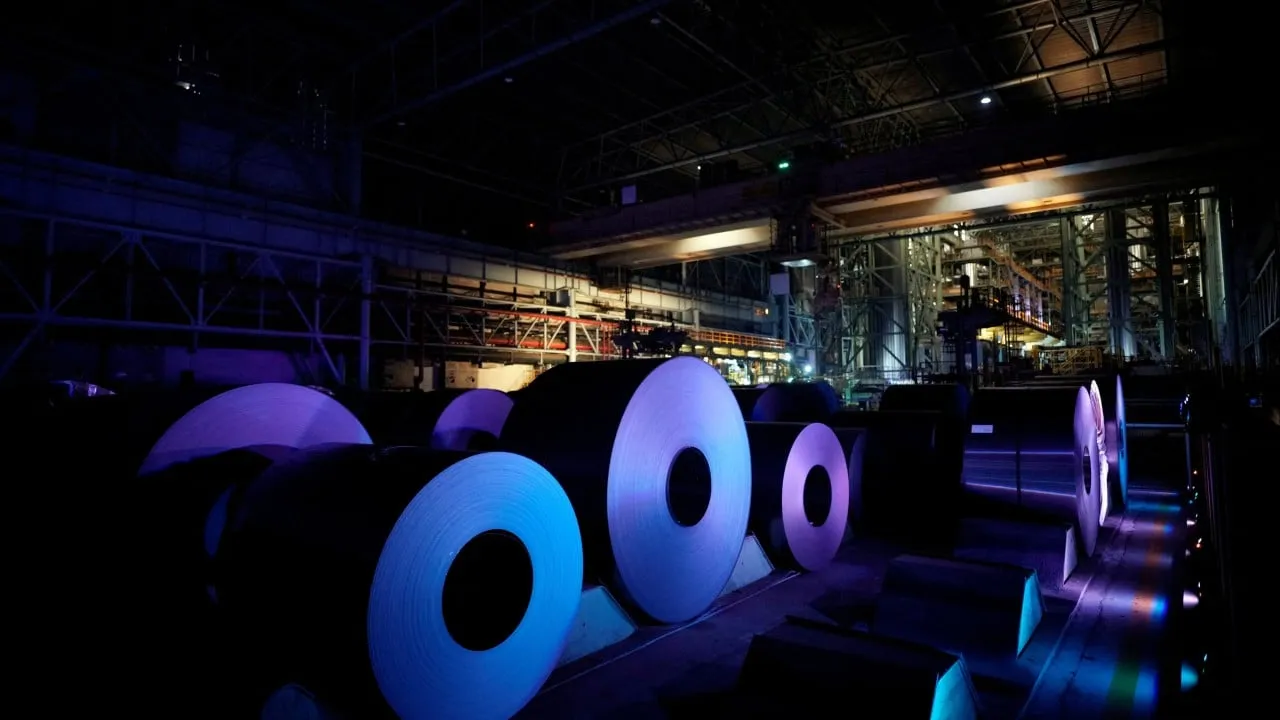

Beijing's economic slowdown is creating significant challenges for Chinese commodities producers, particularly in the steel and oil refining sectors. As the cumulative losses in the world's largest steel industry have reached 34 billion yuan (US$5 billion) over the past nine months, steel mills face difficult decisions to cut output to maintain profit margins affected by China's protracted property crisis.

Profit Declines in Key Sectors

- Oil refining sector losses have intensified to 32 billion yuan.

- Overall profits in industrial firms are declining at an accelerating speed.

- Steel mills are curtailing operations to cope with losses.

Both sectors are bracing for potential bankruptcies if the situation does not improve. In contrast, steel stocks saw a brief rally after China's main industry association proposed measures for consolidation within the industry.

Looking Ahead

- Beijing's recent economic stimulus measures will be crucial for raw materials demand.

- Goldman Sachs foresees a slight uptick in oil consumption.

- Challenges remain for the steel market given the focus on clearing housing stock rather than initiating new projects.

The steel and oil industries are the only major sectors failing to generate profits year-to-date, with other commodities also feeling the weight of a struggling economy and overcapacity concerns. Notably, coal mining profits have plummeted by 22% due to oversupply issues, while chemicals firms report a 4% decline in income.

Investor Sentiment

Despite uncertainties from US-China trade spats, investors are showing a preference for Chinese assets with expectations for further stimulus. Optimism regarding China's copper prices persisted at a recent conference in Shanghai Metals Market, signaling potential expansions within smelting operations.

Beijing's economic challenges and responses will undoubtedly shape the future landscape of China's steel industry and copper markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.