CEF Weekly Review: Understanding High Premiums and Their Fragility

CEF Market Overview

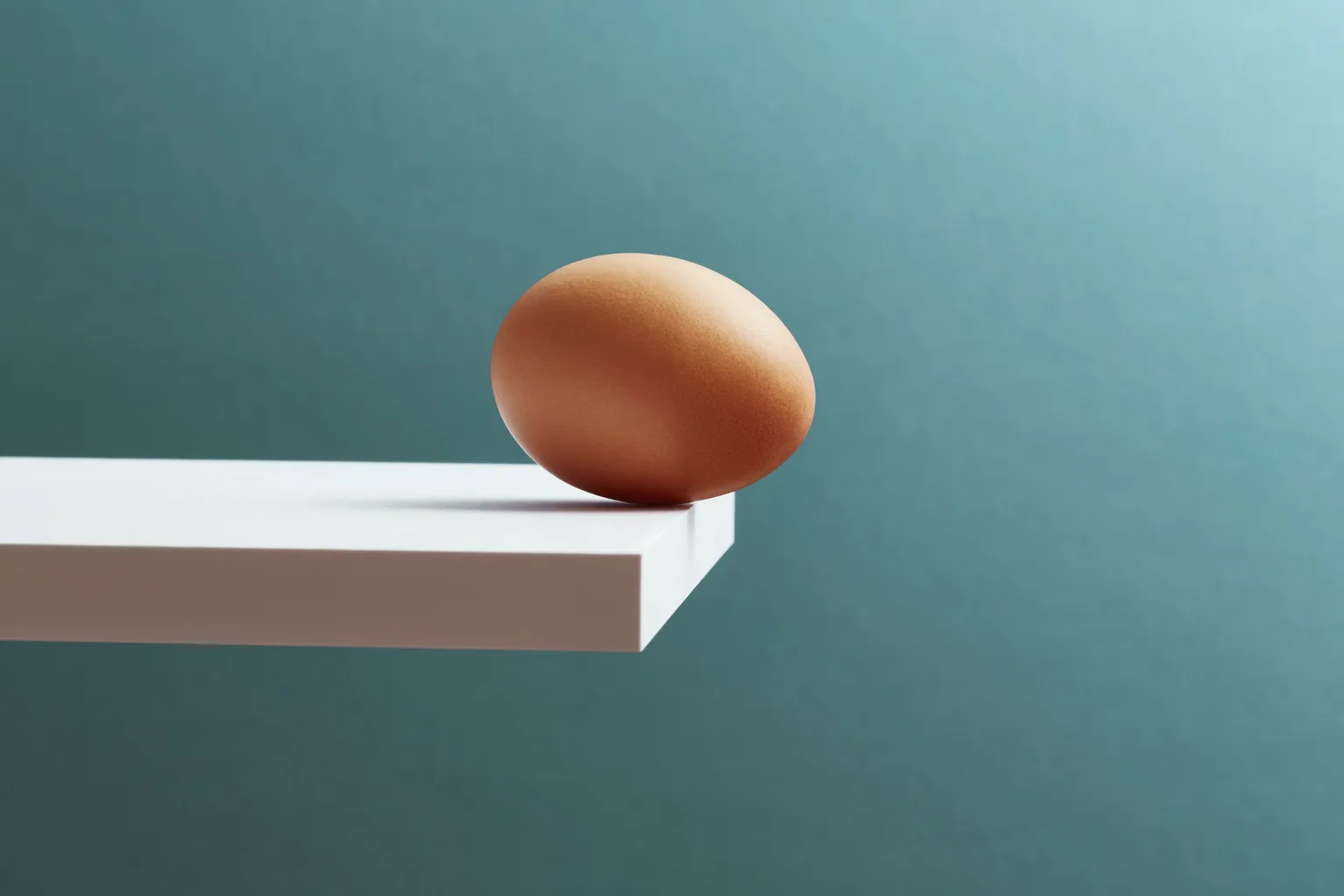

CEF Weekly Review presents a close examination of how high premiums within the Closed-End Fund (CEF) market can easily turn fragile. As discounts have widened, despite strong Net Asset Value (NAV) performance across most sectors, practical strategies are necessary for investors.

Market Valuation Trends

- Discounts Widening: Observations indicate a trend where discounts on many CEFs have started to widen, raising concerns among investors.

- NAV Strength: Despite the widening discounts, many funds are showing resilience with solid NAV growth.

- Sector Performance: Throughout October, performance metrics across various CEF sectors are analyzed to foresee potential shifts.

Key Takeaways

Investors should be vigilant of the current trends impacting CEF valuations. Adjustments in strategy may be required to mitigate risks associated with high premiums and fluctuating discounts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.