VOOV: Insights on the Vanguard S&P 500 Value Index Fund ETF Shares

VOOV: A Critical Look at Large-Cap Value Investing

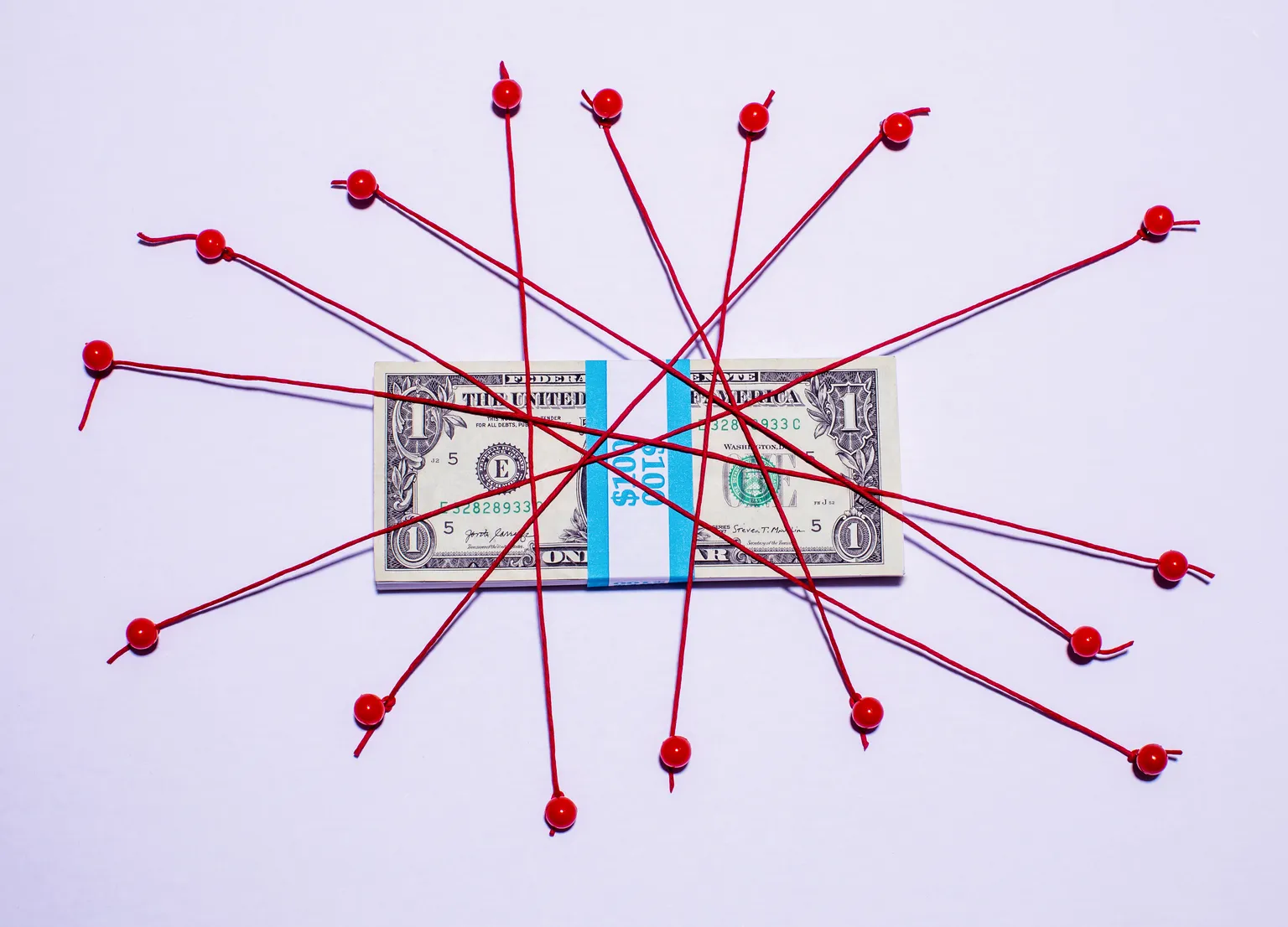

The Vanguard S&P 500 Value Index Fund ETF Shares (VOOV) aims to capture the essence of large-cap value investments, yet it presents some challenges. Investors often regard VOOV for its relative evaluations, but its performance may not suit every investor's strategy.

Key Insights into VOOV's Performance

- Relative Valuations: While VOOV provides valuable insights into large-cap valuations, investors need to look beyond mere numbers.

- Performance Metrics: Examining historical performance can shed light on whether VOOV aligns with your investment goals.

- Market Conditions: Economic shifts impact VOOV’s efficacy in representing large-cap value opportunities.

Is VOOV Right for You?

Determining the suitability of VOOV involves weighing its benefits against potential drawbacks. Analyze your investment strategy thoroughly before making decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.