Why US Markets Fell Amidst Recovery from Big Tech Earnings

Why US Markets Fell: A Closer Look

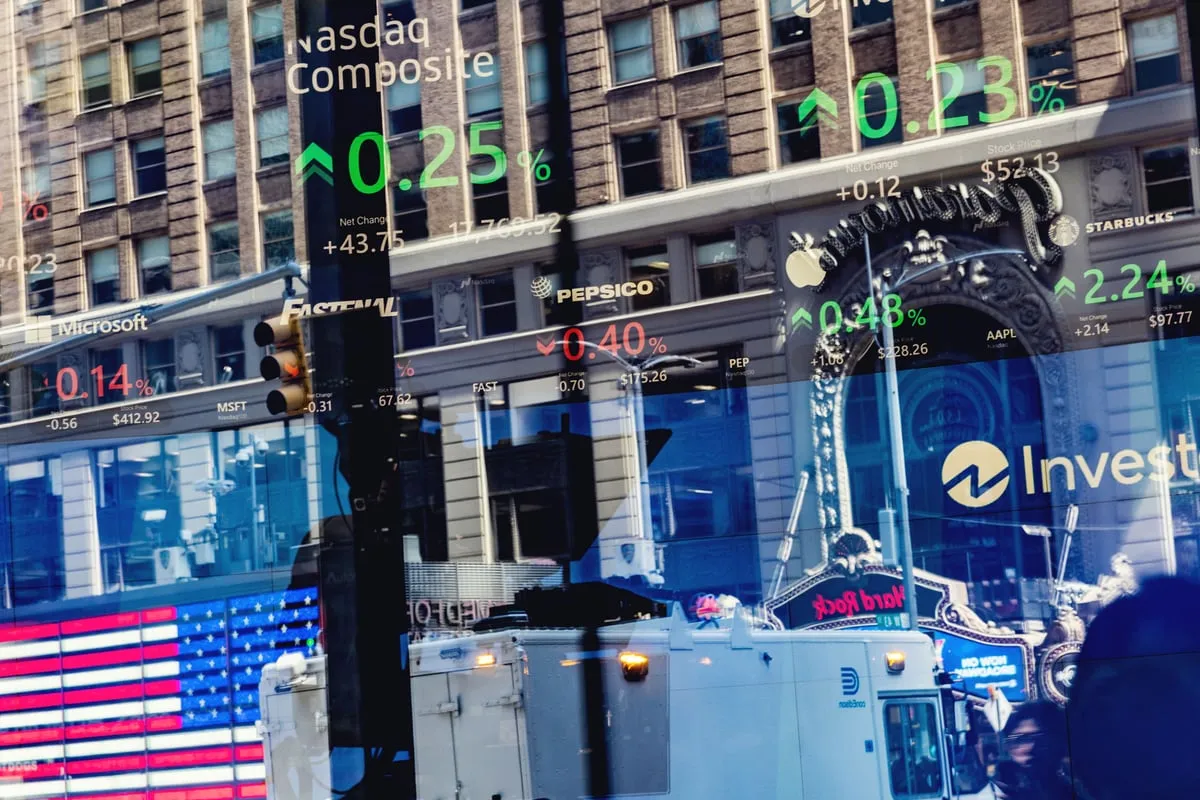

In a surprising turn, US markets fell today with major indices showing downward pressure, including the S&P 500 and the Nasdaq 100. Despite this downturn, tech stocks managed to recover as earnings season kicks off, led particularly by Tesla’s impressive surge of 9% in late trading hours.

Key Factors Driving Market Movement

- Tesla's Performance: The electric vehicle giant announced strong delivery expectations for the quarter, giving investors hope.

- Increased Bond Yields: This raised concerns over potential Federal Reserve actions on interest rates, impacting market sentiment.

- Investor Caution: The upcoming payroll reports and the looming US elections contributed to an air of uncertainty around stock prices.

Market Outlook Ahead

Despite today's market dip, analysts remain focused on potential recovery, citing that the next few weeks will be pivotal with earnings reports from major tech companies and economic data releases.

This economic landscape remains fragile, with experts warning of possible downside risks if market conditions shift.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.