De-Dollarisation: Understanding the Impact of More BRICS Members

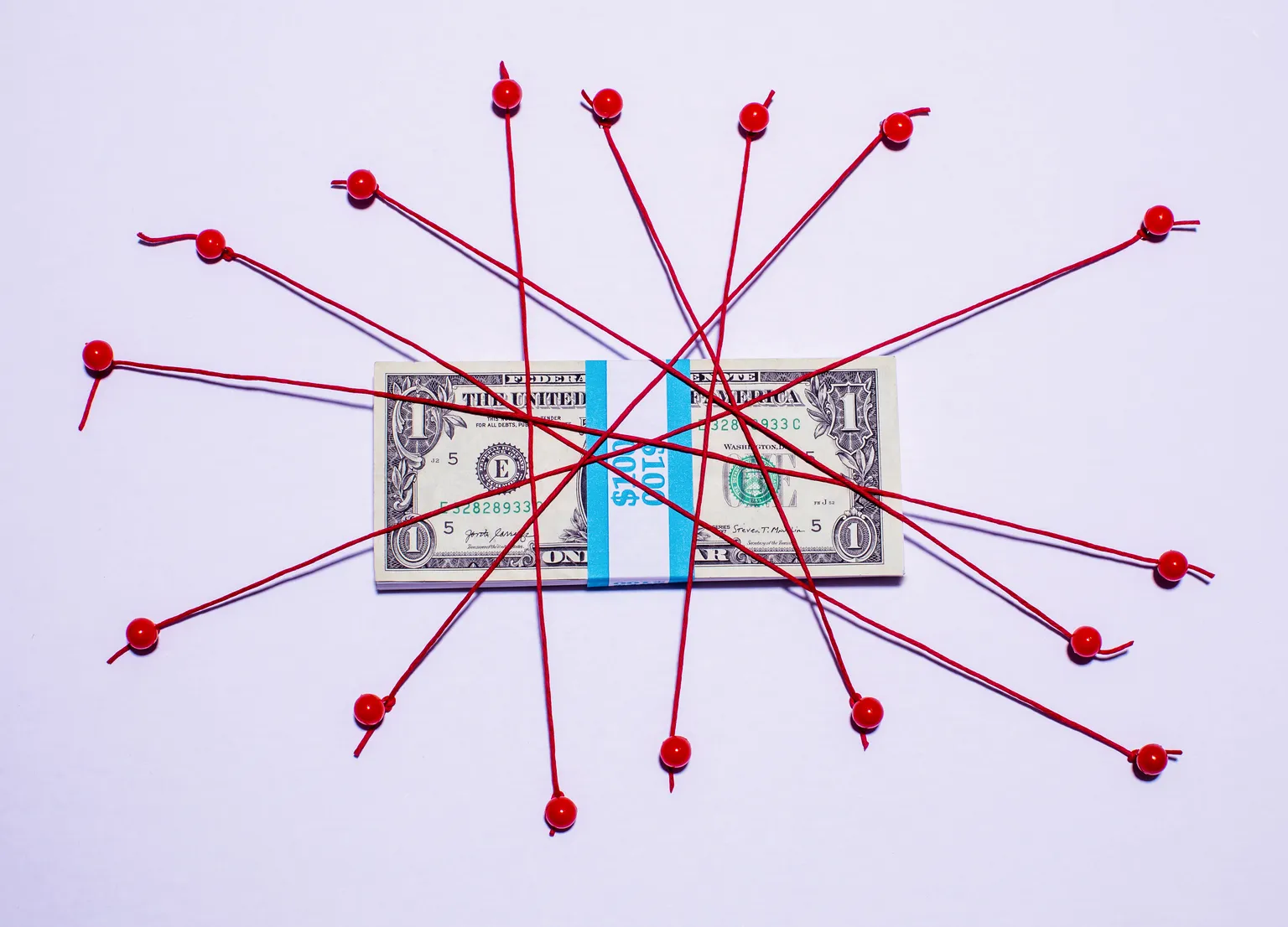

De-Dollarisation: A New Chapter in Global Finance

The recent expansion of BRICS to include Egypt, Ethiopia, Iran, and the UAE signifies a pivotal moment in de-dollarisation. This shift is not merely a headline but a fundamental transformation with far-reaching consequences for financial markets. As these nations strengthen their economic ties, the reliance on the U.S. dollar may diminish.

Implications for Global Trade

The inclusion of these countries could alter trade routes and partnership dynamics. With an increasing number of nations seeking alternatives to the dollar, understanding the impact on global trade becomes vital.

Market Reactions

- Investment Strategies: Investors should recalibrate their strategies to accommodate this shift.

- Currency Fluctuations: Expect increased volatility as currencies adjust.

- New Trading Blocks: Emerging markets may establish new trading alliances.

Conclusion: Preparing for Change

As we move forward, it’s essential for market participants to stay informed about these developments. The trajectory of de-dollarisation is unfolding, with significant long-term implications for the global economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.