E. Coli Outbreak Pressures McDonald's Growth Potential

E. Coli Outbreak Pressures McDonald's Growth Potential

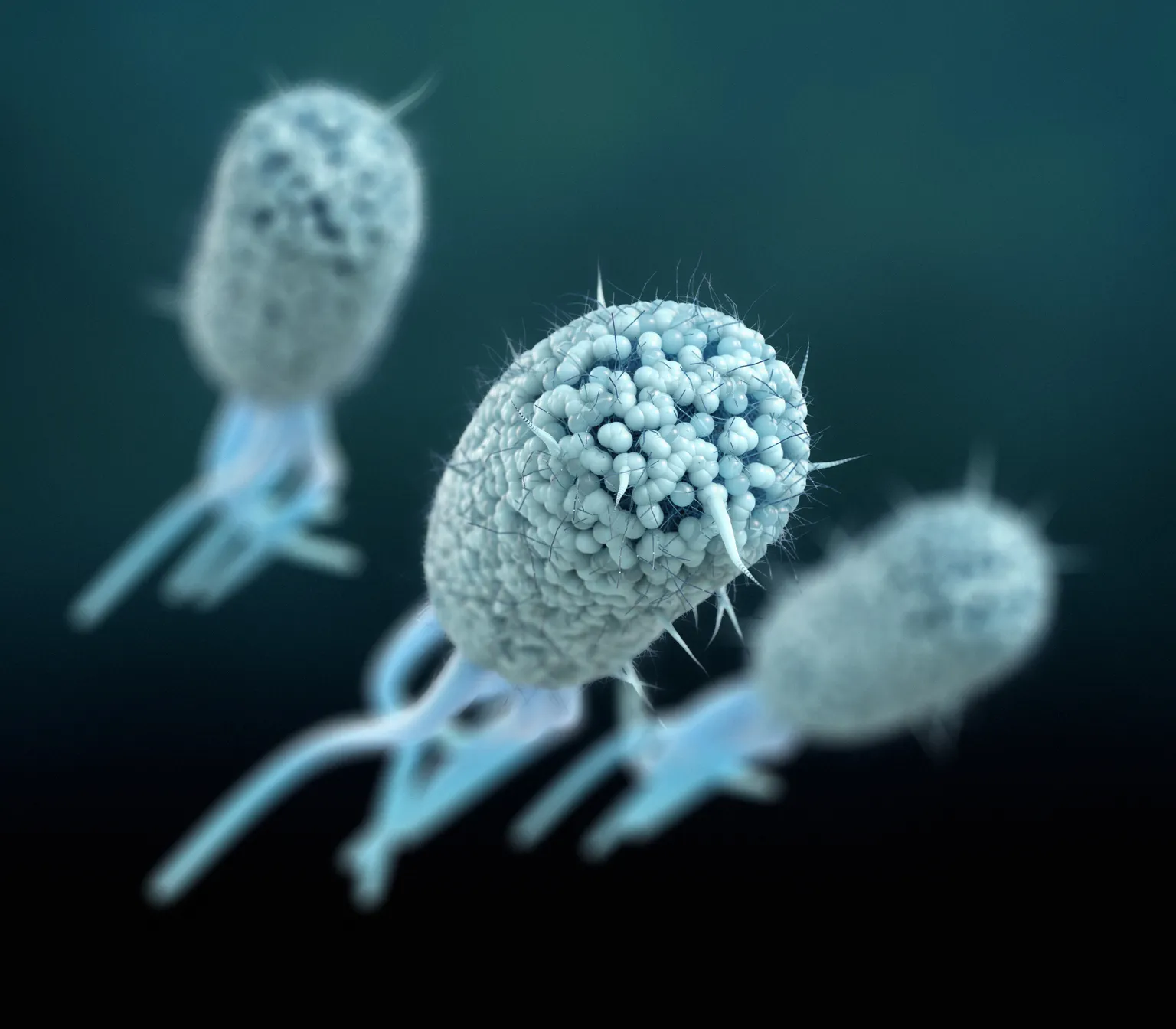

The recent E. coli outbreak poses significant challenges for McDonald's Corporation, threatening its growth trajectory. Analysts anticipate a slowdown in customer traffic as public perception shifts due to health concerns.

Impact of the Outbreak on McDonald's

- Increased Health Awareness: Consumers are more cautious, impacting fast food chains.

- Investor Sentiment: The stock is under pressure from heightened scrutiny.

- Financial Projections: Analysts project a decline in revenue during this period.

Analyst Ratings and Fair Value

Due to these developments, the recommendation for McDonald's shares has shifted to ‘Sell’, with analysts setting a fair value target at $240 per share. This rating reflects not only short-term risks but also the potential long-term effects on brand reputation.

Implications for Investors

As the situation unfolds, investors should remain vigilant. The E. coli incident is a reminder of how quickly circumstances can change in the fast-food sector, and the importance of maintaining a diversified portfolio.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.