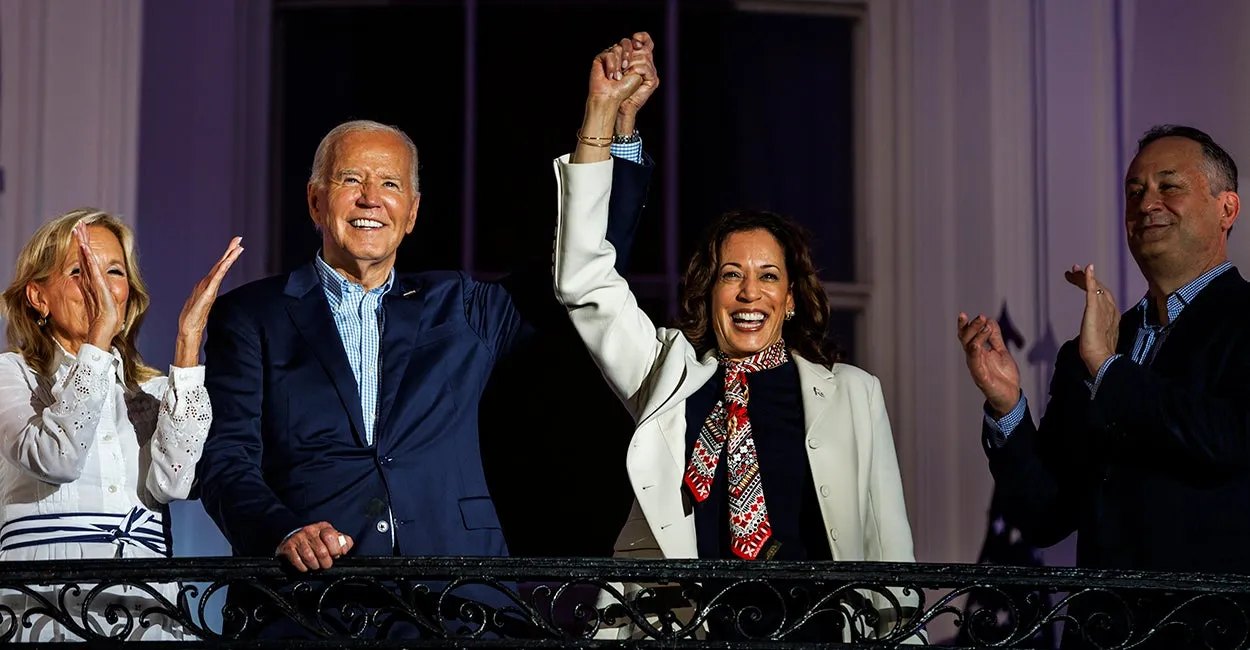

Biden-Harris Administration and Its $8 Trillion Debt Growth Insights

The Biden-Harris Administration's Impact on Debt and Deficits

In an overview of financial stability, the Biden-Harris administration stands out for its staggering $8 trillion increase in national debt. Such a profound shift has resulted partly from misguided government spending, including a controversial stimulus package that aimed to bolster a cautious economy. However, analysts are increasingly concerned about the correlation between heightened interest rates and ongoing deficits, raising questions about future economic sustainability.

Government Spending and Its Consequences

- Deficits are rising at an alarming rate.

- The stimulus package created immediate financial relief but added long-term liabilities.

- Attention to fiscal sanity is crucial as we approach fiscal year 2025.

Assessing Economic Sustainability

- Projected increases in deficits are concerning.

- Interest rates continue to be a focal point of economic discussion.

- The challenge of balancing government spending with fiscal responsibility remains daunting.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.