Understanding 2025 Tax Returns Amid Rising Inflation and Taxes

2025 Tax Returns and Inflation Rates

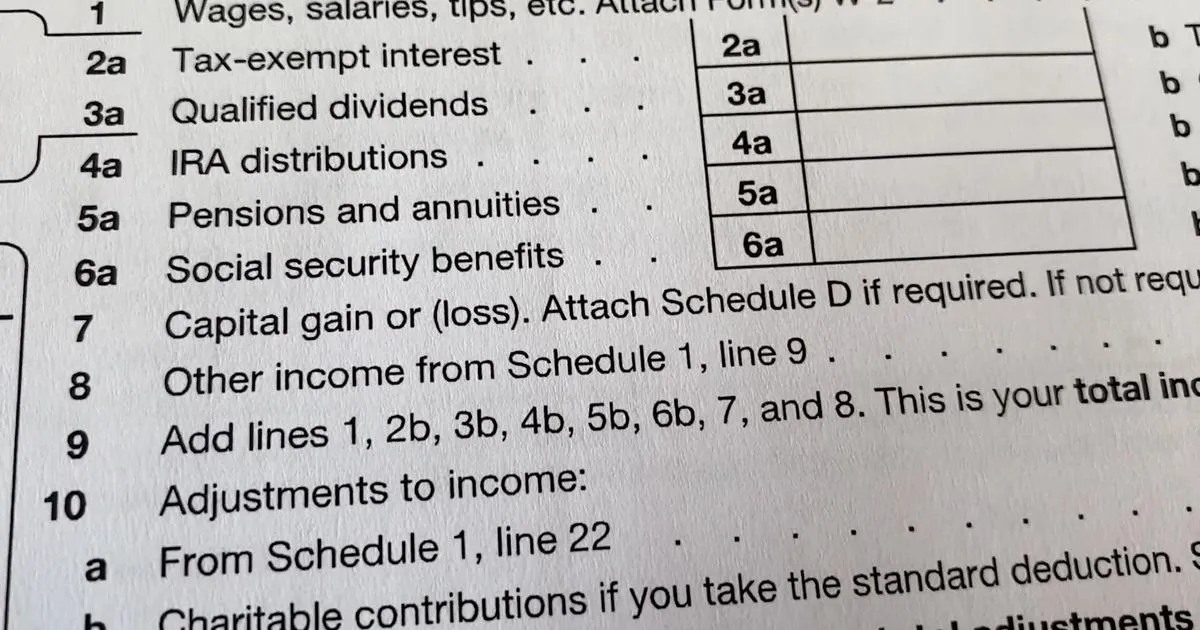

The upcoming changes in 2025 tax returns are largely driven by inflation. Taxpayers must be prepared for new adjustments in tax brackets that the IRS will implement. These modifications are essential for both taxes and individuals' financial strategies.

Key Changes in Taxes Due to Inflation

- Increased tax thresholds for all brackets.

- Potential impact on how much money taxpayers can keep after obligations.

- Adjustments that reflect the actual cost of living increase.

Implications for Financial Planning

- Consider how new payments may affect budgets and savings.

- Review money management strategies to adapt to changes.

- Explore options for maximizing deductions with the new laws.

In summary, understanding the intricacies of the 2025 tax returns is vital for anyone looking to navigate the fiscal landscape effectively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.