Paytm Results Show Significant Revenue Growth, Prompting Analyst Upgrades

Paytm's Q2FY25 Performance Highlights

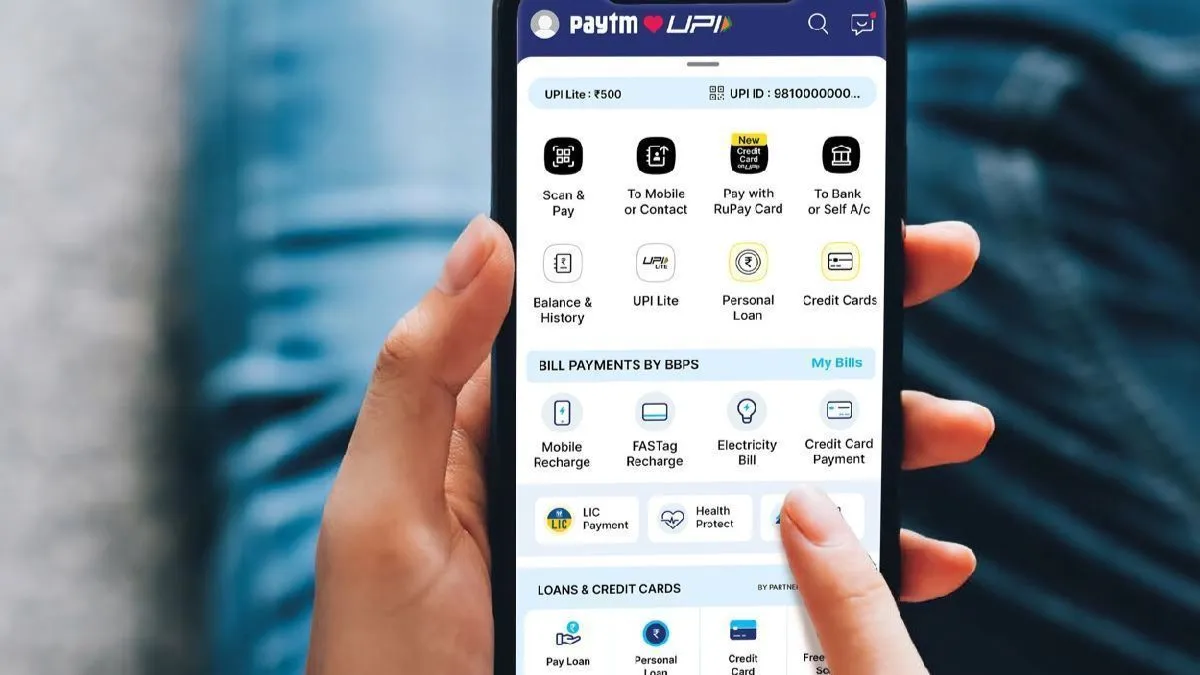

Paytm, the leader in mobile payments, showcased impressive Q2FY25 results with a remarkable 11% quarter-on-quarter (QoQ) revenue growth to Rs 1,660 Cr, significantly boosted by its expanding payments and financial services. Analysts displayed confidence in Paytm's future as several brokerage firms reiterated their positive ratings, driven by effective cost management and optimistic signals from regulatory advancements.

Analysts' Ratings and Price Targets

- Yes Securities upgraded Paytm's stock rating to ‘Buy’, projecting a price target of Rs 800, citing clear pathways to EBITDA breakeven.

- Goldman Sachs echoed this sentiment, raising their price target to Rs 480 while maintaining a ‘Neutral’ rating, anticipating profitability by FY27.

- Bernstein called the Q2 results strong, setting an ‘Outperform’ rating with a target of Rs 600, highlighting the significance of the recent NPCI approval for new UPI users.

The Road Ahead for Paytm

The continued positive trends combined with regulatory clarity positions Paytm favorably to enhance its market landscape. With strong demand for its financial services, analyst expectations support a bullish outlook for the next fiscal year.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.