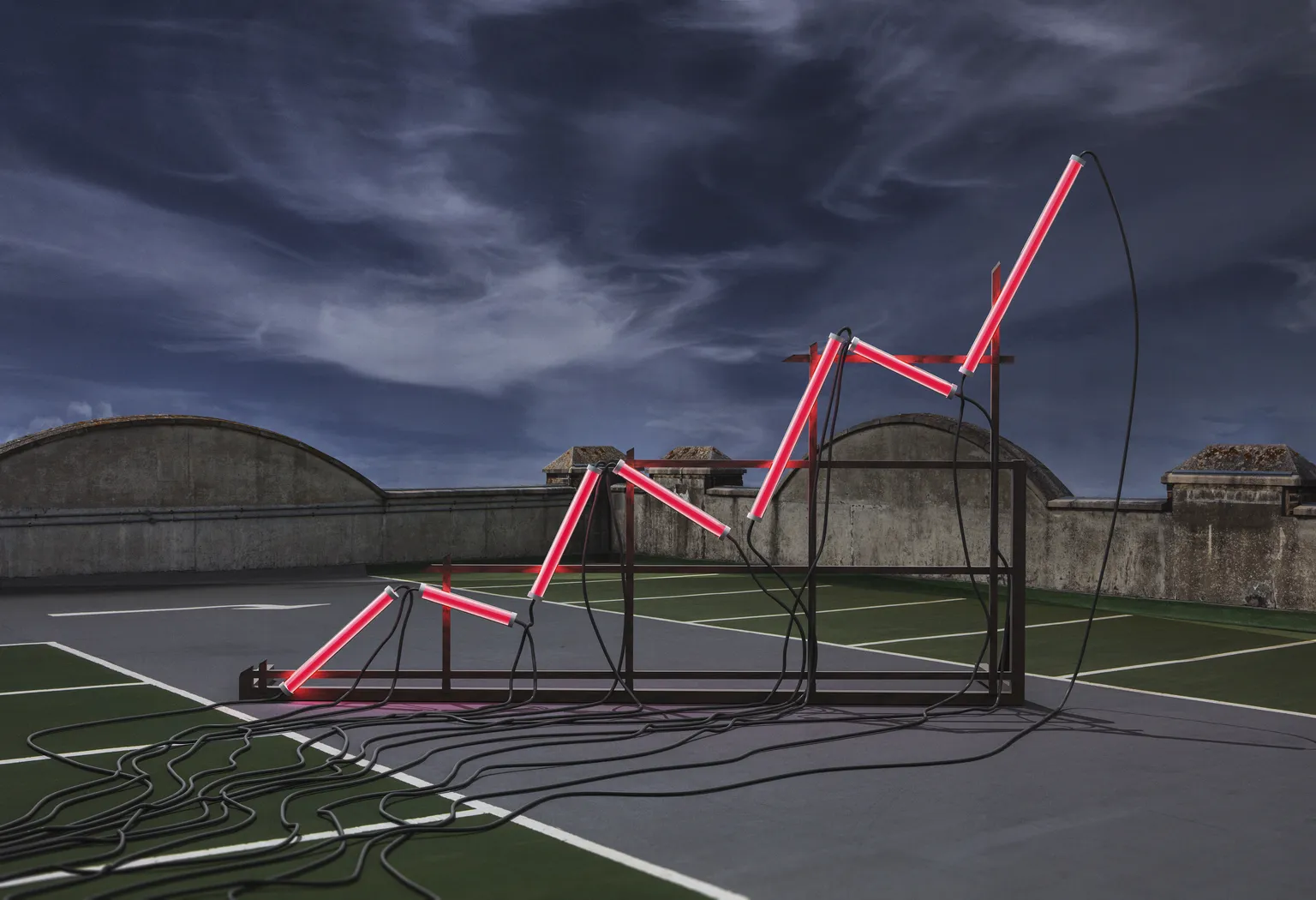

10-Year Treasury Rate May Rise Above 6% Amid Inflation Pressures

The Economic Landscape and Treasury Yields

The outlook for the 10-Year Treasury rate hints at a potential rise above 6% due to strong economic data. Recent reports indicate inflation remains persistent, challenging the Federal Reserve's monetary policy.

Understanding the Drivers Behind Rising Rates

- Economic Growth: Positive data points reveal a resilient economy.

- Inflation Trends: Ongoing inflationary pressures continue to influence yield behavior.

- Market Reactions: Investor sentiment shifts as they adjust to anticipated rate hikes.

Implications for Investors

For investors, understanding the 10-Year Treasury rate dynamics is crucial. As yields rise, bond prices may decline, altering investment strategies.

Stay informed and consider adjustments to your portfolio as we monitor this unfolding situation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.