Options Expiry for Bitcoin and Ether: A $4.2B Wave of Potential Volatility

Options Expiry Dynamics

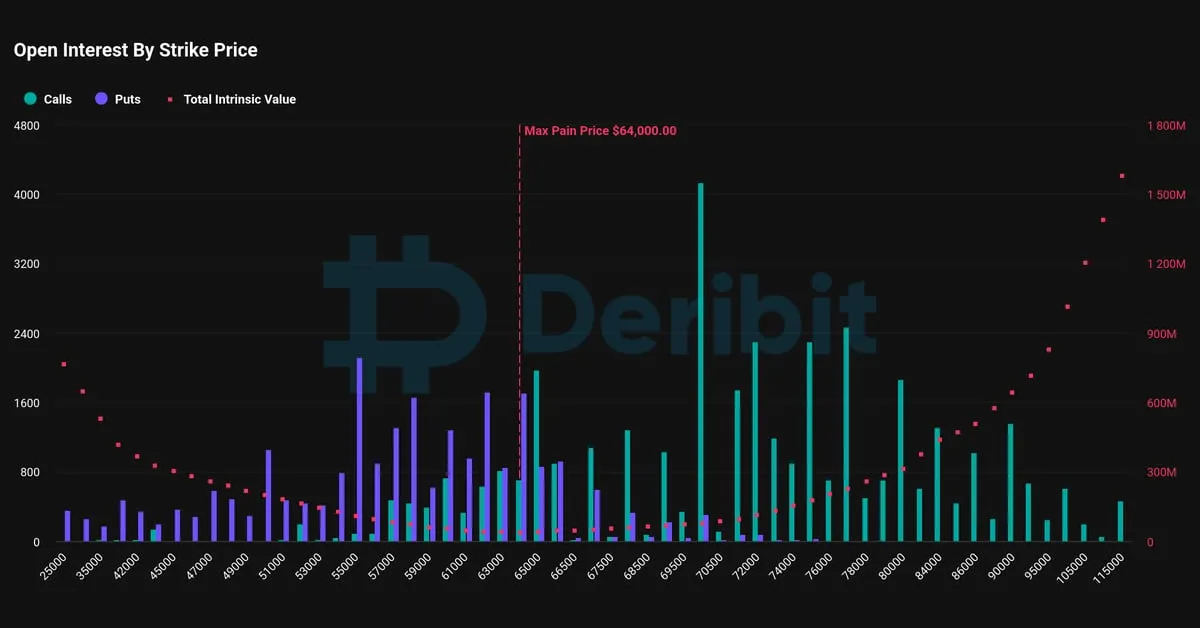

Options expiry approaches with both Bitcoin and Ether facing a staggering $4.2 billion in options set to expire, heightening anticipation across cryptocurrency trading platforms. With around 16% of Bitcoin options currently classified as in the money, traders are poised for potential market fluctuations.

Key Considerations for Traders

- Monitor the impact of Deribit on market stability.

- Assess the implications of such a significant expiry on trading strategies.

- Prepare for increases in market volatility as positions are settled.

The culmination of these factors suggests a period where both Bitcoin and Ether could experience heightened swings, potentially reshaping trader sentiment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.