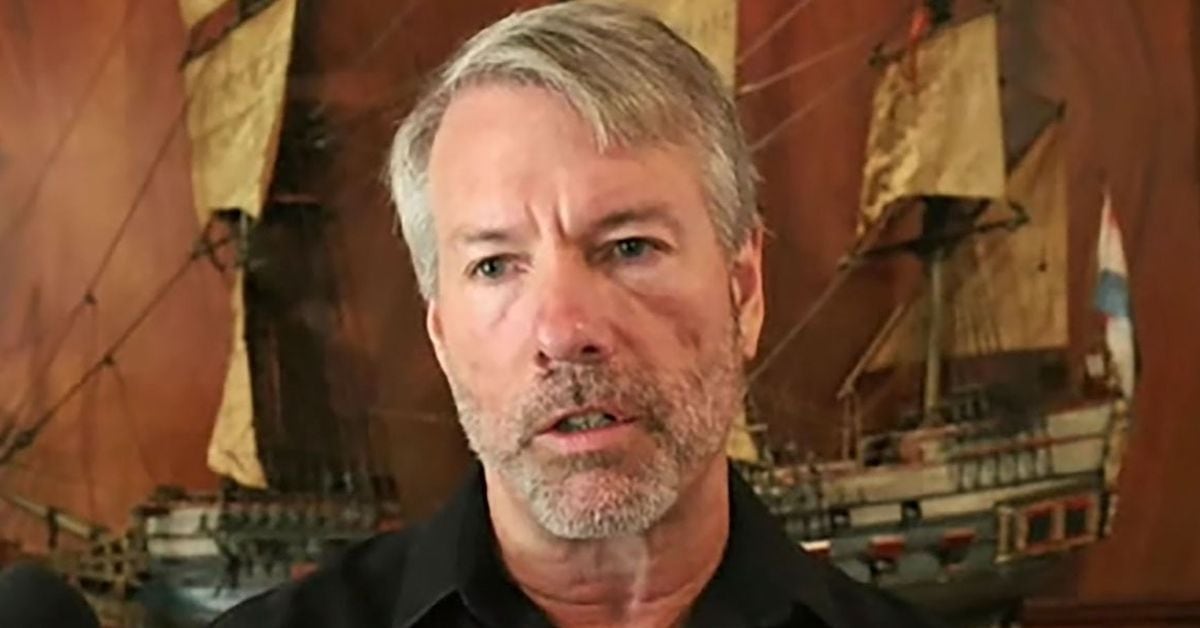

MicroStrategy Founder Michael Saylor Agrees to $40M Settlement in D.C. Income Tax Case

Monday, 3 June 2024, 12:04

MicroStrategy Founder Michael Saylor Settles Tax Case

The District of Columbia sued Saylor in 2022 for allegedly not paying income taxes while living in the district.

Key Details:

- Issue: Alleged non-payment of income taxes

- Settlement: $40 million settlement reached

- Legal Battle: Concluded with the agreement

The settlement highlights the financial consequences of tax non-compliance, especially for high-profile individuals like Saylor.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.