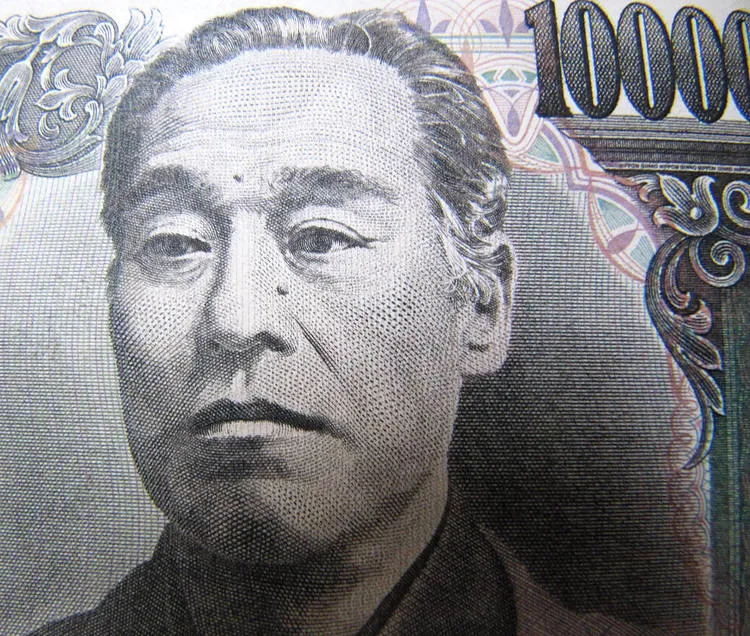

USDJPY Analysis: BOJ Politics and Fed Influence Create Yen Vulnerability

USDJPY: BOJ Politics and Fed Dynamics Create Vulnerability

The currency pair USDJPY is facing significant challenges, hovering near its lowest level since late July as BOJ politics and Fed decisions intertwine. Recent shifts in monetary policies have left the Japanese Yen susceptible to volatility, underscoring the interconnectedness of global market forces.

Market Reactions to Central Bank Policies

- The impact of BOJ's stance on interest rates is pivotal.

- Fed's policy adjustments are equally influential on USDJPY movements.

Investor Sentiments and Future Trends

As investors analyze economic indicators, market sentiments can shift rapidly. Monitoring shifts in both central banks' policies will be crucial for predicting future currency movements.

For more insights on this dynamic situation and its implications for financial markets, please follow our updates.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.