Taiwan Semiconductor: Why You Should Invest in TSM for Long-Term Gains

Monday, 21 October 2024, 17:05

Why Taiwan Semiconductor is a Top Investment Choice

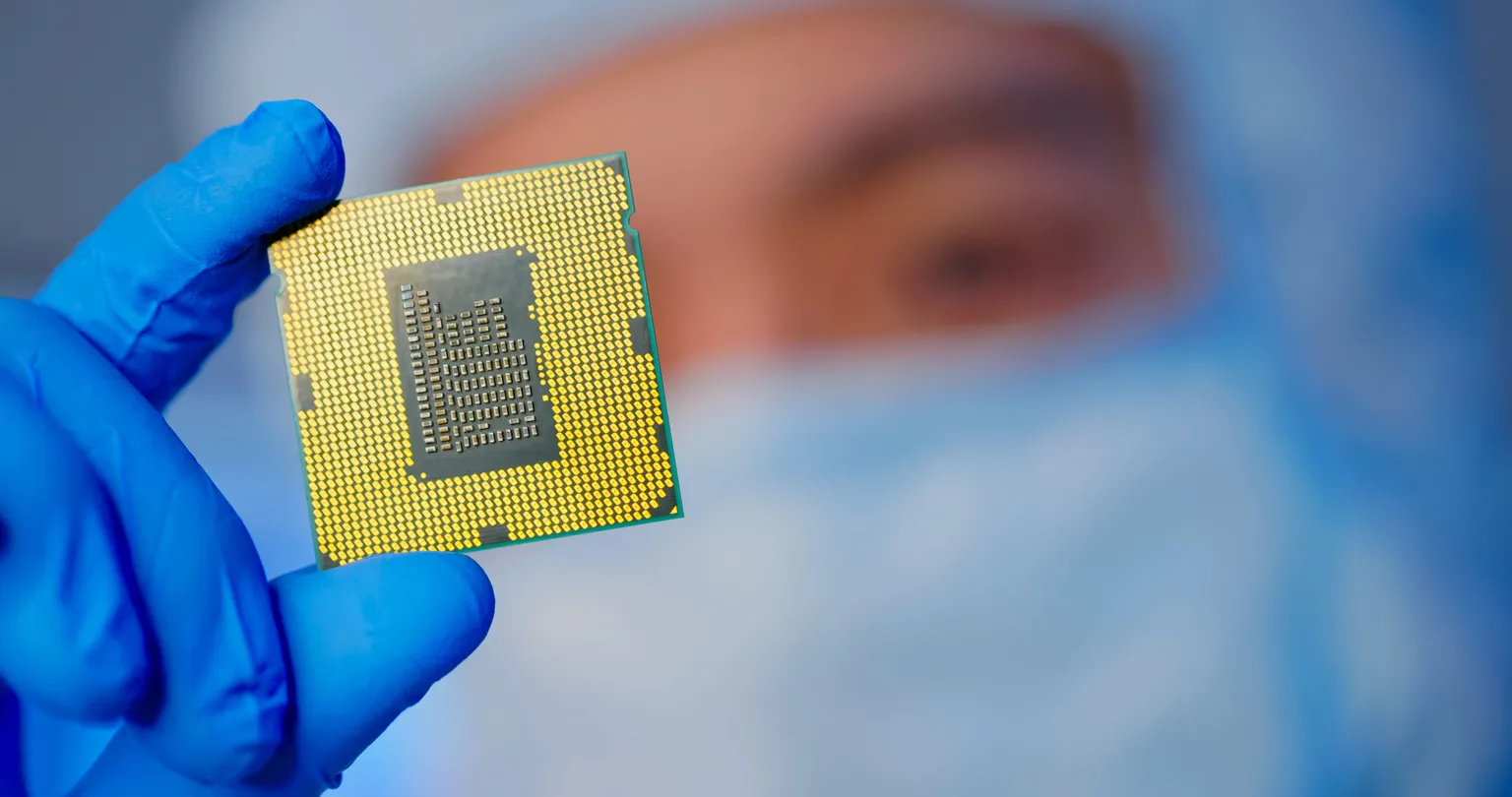

Taiwan Semiconductor Manufacturing Company (TSMC) has established itself as an industry leader, providing critical semiconductor components that drive modern technology. With unmatched production capabilities and a commitment to cutting-edge research and development, TSMC is well-poised to capitalize on increasing global demand for chips.

Financial Strength and Competitive Moat

- Strong Financial Performance: TSMC consistently demonstrates robust revenue growth, reflecting its dominant market share and pricing power.

- Technological Advancements: Continuous investment in advanced manufacturing technologies keeps TSMC ahead of competitors.

Future Growth Prospects

- Increased Demand: The proliferation of AI, IoT, and 5G technologies will continue to boost semiconductor needs.

- Diverse Customer Base: TSMC serves a wide array of high-profile clients across different sectors, enhancing revenue stability.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.