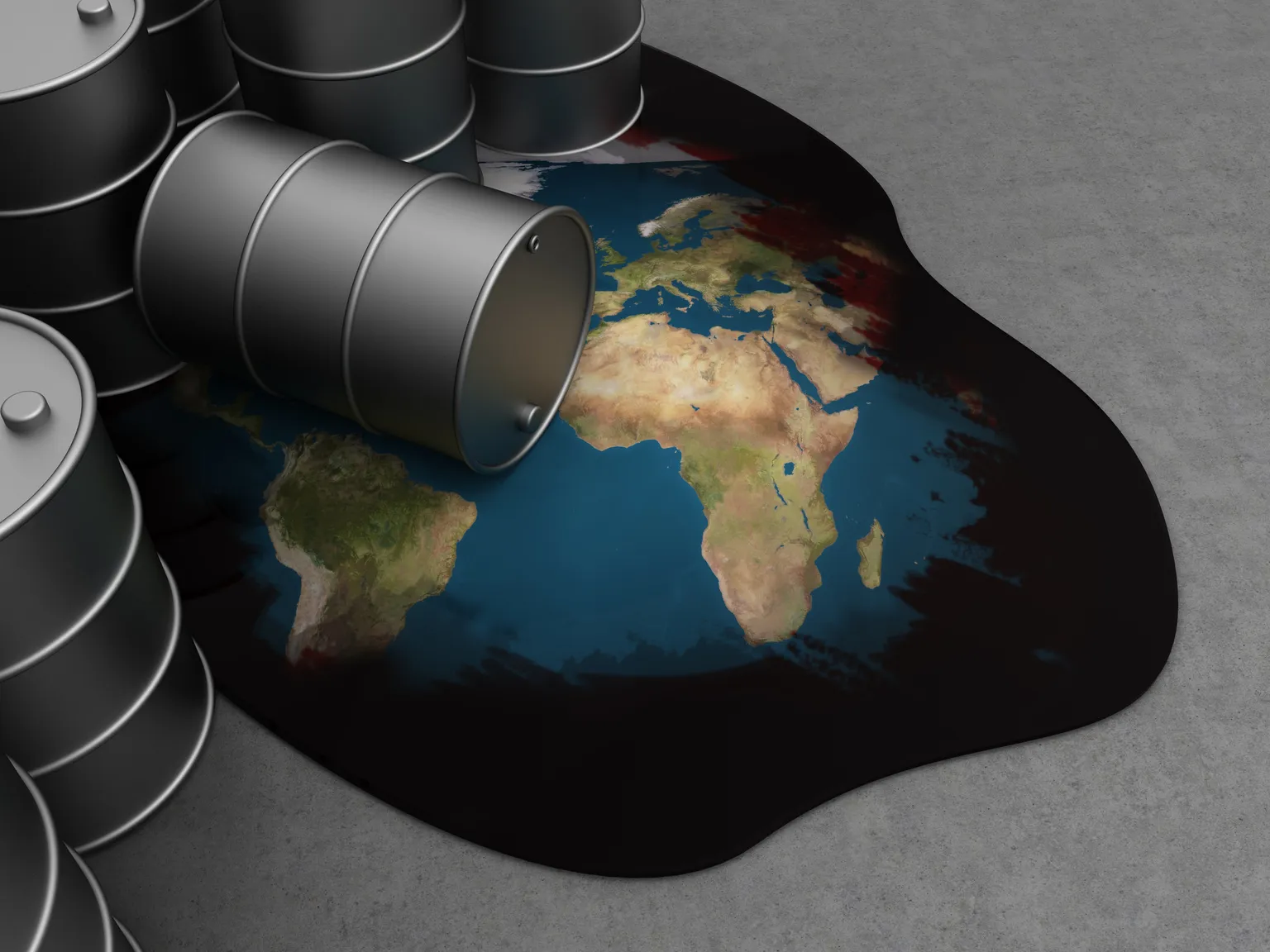

Will War Trigger A Bear Market And Spike In Oil? A Financial Analysis

Geopolitical Tensions and Market Dynamics

In recent times, escalating conflicts have raised concerns about their influence on global markets. War can significantly impact economic stability, leading to uncertainty in investment strategies.

Impact on Oil Prices

Historically, conflicts in oil-rich regions have resulted in dramatic spikes in oil prices. This surge can strain various sectors of the economy, raising fuel costs for consumers and businesses alike.

Bear Market Outlook

A potential bear market may emerge as investors react to rising oil prices and declining economic forecasts. During such downturns, historical data suggests that risk aversion increases. The stock market often mirrors these trends, reflecting investor sentiment amidst fear of reduced consumer spending.

Investment Strategies

Investors should evaluate their asset allocations. Considering the anticipated fluctuation in bond yields, adjusting portfolios to mitigate risks linked to rising oil prices might be prudent.

Conclusion: Staying Prepared

In summary, the potential for war to trigger a bear market and oil price hikes remains a critical consideration for investors. Staying informed and adjusting strategies accordingly is essential for navigating these turbulent times.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.