HKMA’s Sustainable Finance Action Agenda: Goals for Carbon Neutrality by 2030

HKMA Sets Ambitious Targets for Carbon Emissions

HKMA has outlined that all banks in Hong Kong will need to achieve net zero greenhouse gas emissions by 2030. The Hong Kong Monetary Authority’s Sustainable Finance Action Agenda mandates that lending to businesses and projects linked to high emissions aligns with net zero goals by 2050.

The Role of HKMA in Sustainable Finance

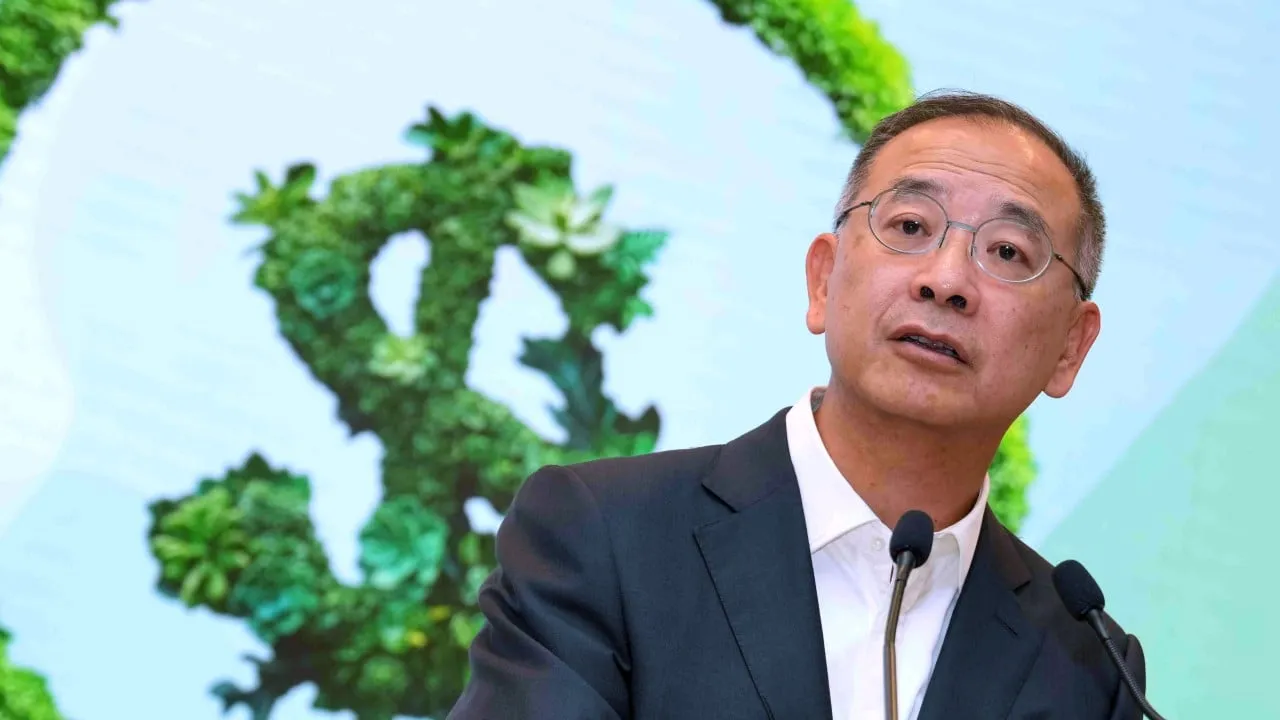

Eddie Yue Wai-man, CEO of HKMA, emphasized that combating climate change is critical and stated, “Hong Kong as a global financial center must facilitate sustainable fund flows.” The HKMA aims to ensure that the Exchange Fund fulfills its net-zero investment compliance by 2050.

- Efforts will include issuing guidelines for banks to cut carbon emissions.

- Banks must report on their strategies to phase out lending to high carbon emission businesses.

- Strategies to promote the issuance of green bonds will also be enhanced.

HKMA’s Strategic Partnerships and Investments

Cheung Leong, chief strategy officer of the Exchange Fund Investment Office, noted prior investments in sustainable projects, highlighting that these initiatives can generate returns comparable to other investments.

- 2013 - Wind turbine project investment in Europe.

- 2017 - Solar energy projects in South America.

- Banks must transition towards operationally net-zero practices by 2030.

The HKMA aims for a significant increase in green bonds issued in Hong Kong, with expectations to rise from 22% to 33% of total bond issuance.

In conclusion, with these initiatives, HKMA is paving the way for Hong Kong to be a leader in sustainable finance across the region.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.