Lumen: Examining the Turnaround and Valuation Risks of LUMN Stock

Lumen's Impressive Fiber Deals

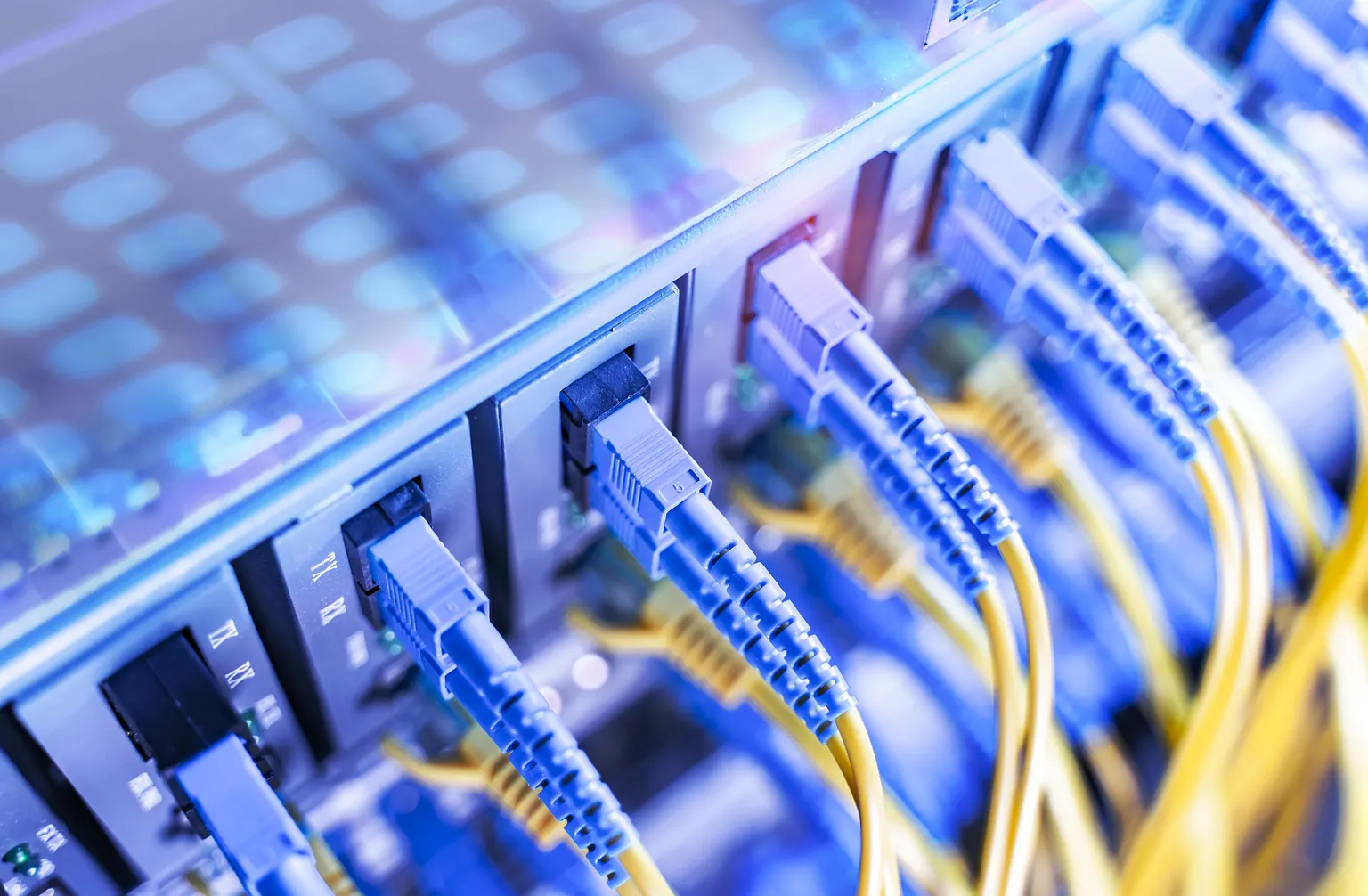

Lumen Technologies has recently accomplished an impressive feat, securing crucial fiber deals that have propelled its conduit network forward. This strategic growth has resulted in a remarkable 400% increase in its stock price, sparking interest across the investment community.

Assessing the Cost of LUMN

While the growth trajectory for Lumen appears promising, investors need to be cautious. The high valuation of LUMN stock could pose risks if market conditions shift or if expectations are not met.

Future Outlook for Investors

- Potential Market Fluctuations: As always in the financial markets, volatility is a constant threat.

- Strategic Plans: Lumen's ongoing plans to expand its fiber network will be pivotal.

- Monitoring Economic Indicators: Keeping an eye on broader economic trends will be crucial for assessing LUMN's trajectory.

Investing in Lumen Technologies might seem enticing given its impressive turnaround, but investors should remain vigilant about its stock valuation and the potential impacts of changing market dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.