Boeing's Strikes: A Business Strategy to Bolster Finances

Boeing's Financial Dilemmas

Boeing's recent financial struggles have come under sharp scrutiny as the company contemplates asset sales to alleviate its fragile finances. As tensions mount from strikes and operational challenges, business executives are considering divesting non-core assets.

Strategic Asset Sales

- Business operations are being reassessed.

- Focus on finances drives the decision to unload.

- Strikes have prompted a rethink of core business practices.

As Boeing navigates these turbulent waters, its strategy to shed non-performing units becomes clearer. Each asset sale serves as a potential lifeline, aiming to stabilize their finances.

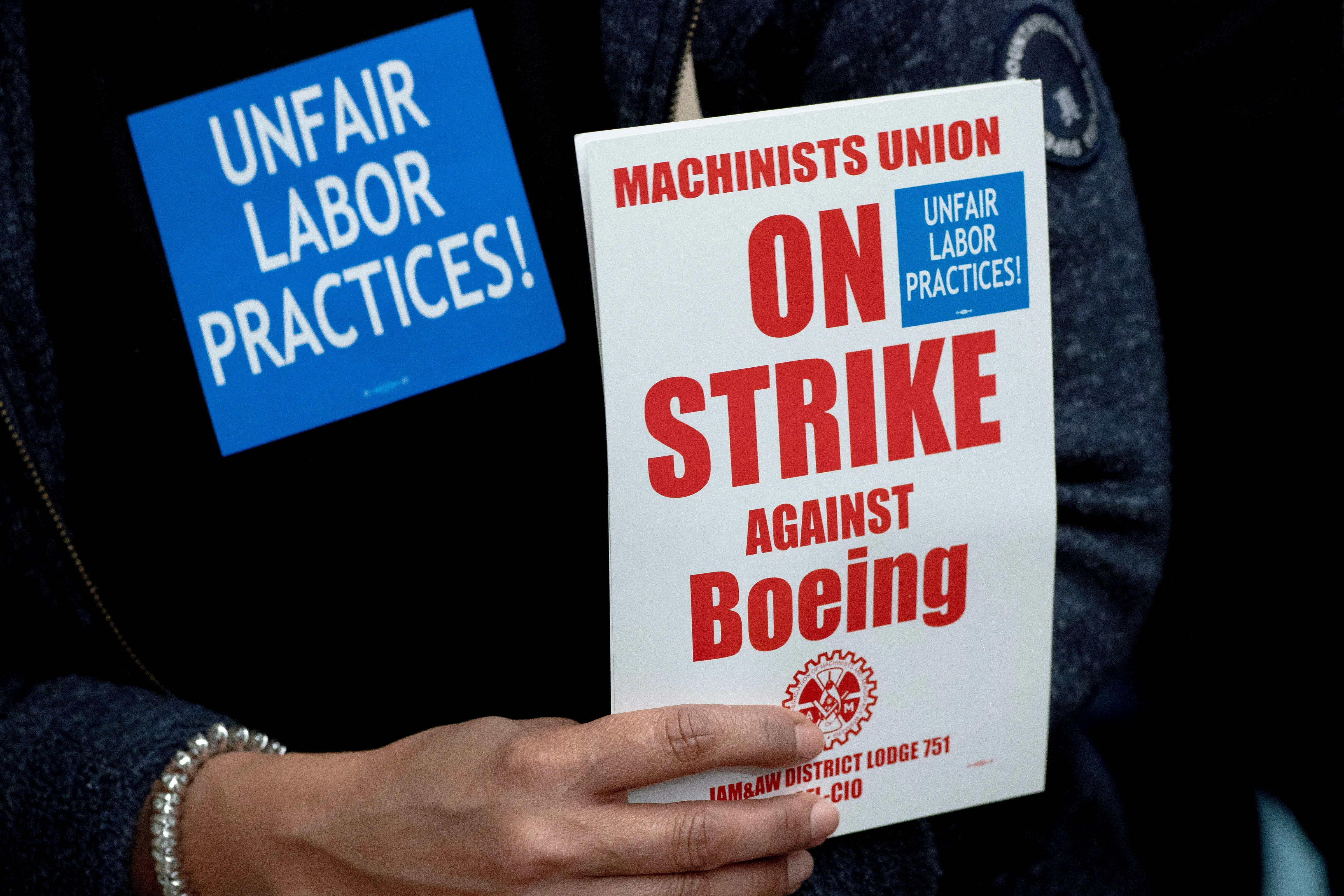

Impact of Strikes

- Short-term financial losses are anticipated.

- Long-term resiliency is at stake.

- Business dynamics shift with each strike.

The ongoing strikes not only impact workflow but also threaten Boeing's bottom line. Continued losses force a reevaluation of their approach to maintain market presence.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.