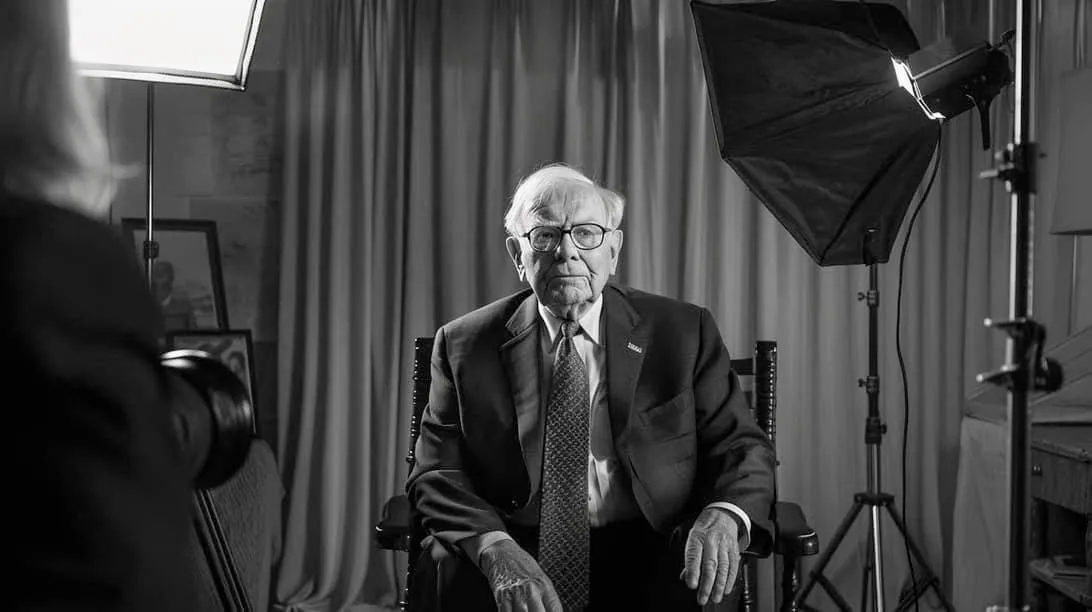

Finance Insights: Understanding Warren Buffett's Bank of America Selling Spree

Warren Buffett’s Strategic Moves in the Banking Sector

Warren Buffett's Berkshire Hathaway (NYSE: BRK.A) has triggered discussions by offloading significant stakes in Bank of America (NYSE: BAC). Currently holding approximately 9.97% of BofA's stock, which equates to about 7.689 billion shares, the recent sale of 8.7 million shares for around $370 million raises important questions in the finance sector.

The Economic Implications

Economist Henrik Zeberg opines that this ongoing sale might signal broader economic concerns. With reports showing U.S. banks experiencing unrealized losses seven times greater than during the 2008 financial crisis, analysts are wary. These losses, arising from decreased value in investment securities, underline potential financial instability within the banks.

- Impact on Regional Banks: The KRE index reflects only temporary recovery since the banking panic of May 2023, indicating that challenges remain.

- Long-term Insights: Buffett's actions could indicate a deeper understanding or prediction of worsening issues within the banking sector.

Concerns Over Potential Market Turmoil

Buffett's position sheds light on possible economic downturns. With the Federal Reserve recently cutting rates by 50 basis points and the S&P 500 reaching heights, the tension builds. Zeberg predicts continued turbulence could arise despite current market strength.

- Recession Probability: Speculation around Buffett's selling coincides with economic recovery uncertainties.

- Market Predictions: Observations regarding the SPDR Financial Sector ETF (XLF) show bearish signals indicating possible declines.

Conclusion: Looking Ahead in Finance

As we ponder Warren Buffett's recent financial maneuvers, it's essential to stay vigilant regarding the underlying messages these changes convey about investment strategies and market health. Keep an eye on market indicators to gauge the economy’s trajectory.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.