dailymail Money Comment: The Key Traits of Successful Fund Managers

The Importance of Continuous Learning

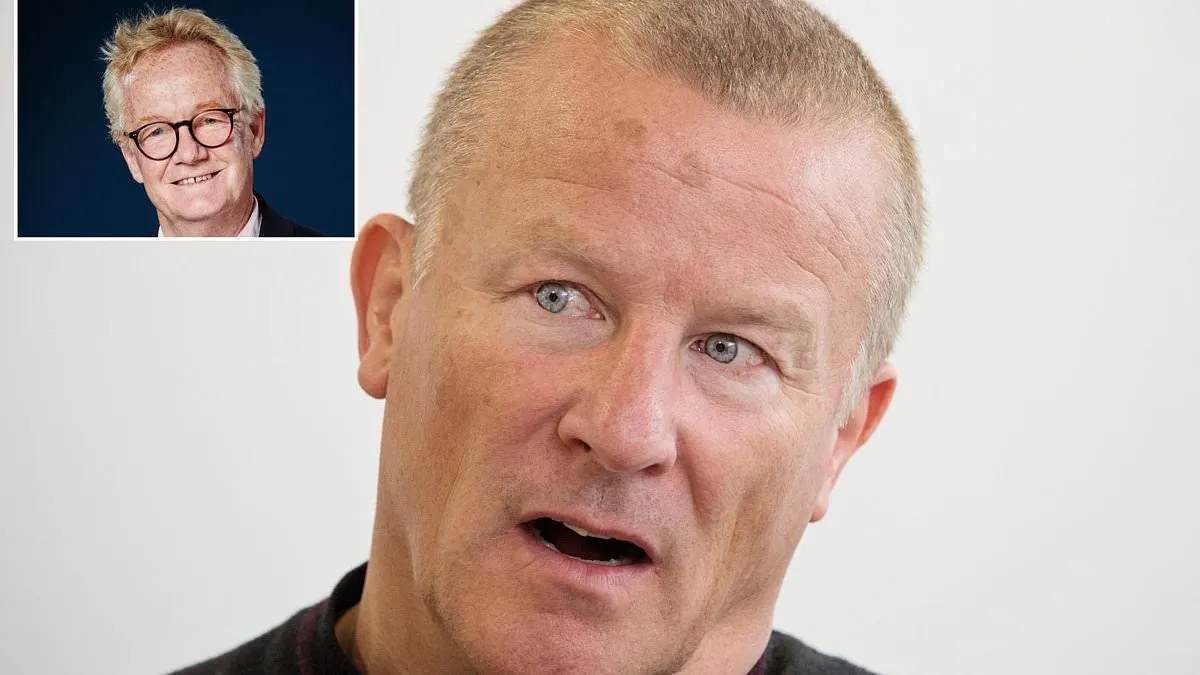

In today's financial landscape, great fund managers must quickly adapt to shifting market dynamics. Learning from past experiences, both good and bad, is crucial. A prime example is the rise and fall of Neil Woodford, whose unexpected decisions led to significant losses.

Conducting Thorough Research

Every successful fund manager understands the necessity of rigorous research. Understanding market trends, evaluating company performances, and assessing economic indicators are all vital components of a sound investment strategy.

Lessons from Failures

- Be open to change

- Learn from mistakes

- Never become complacent

The financial sector is unforgiving. As the situation with Neil Woodford illustrates, lacking due diligence can result in a catastrophic downfall. Investors must carefully vet their fund managers to ensure their strategies align with market realities.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.